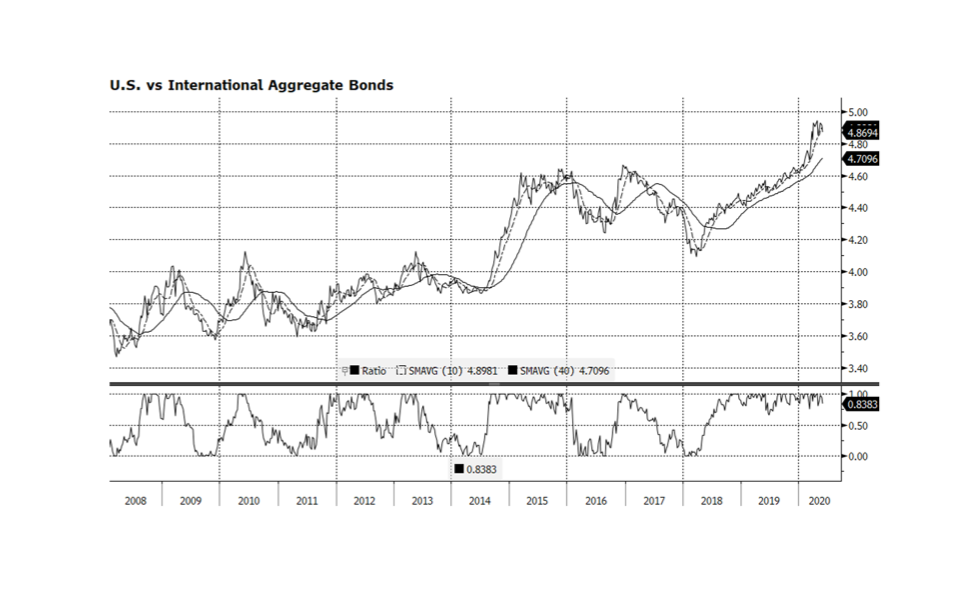

The Bloomberg Barclays Aggregate Bond Indices are widely considered to be the global standard for fixed income gauges. This week we compare the US Aggregate vs. the International Unhedged Aggregate. Over the long-term (12 years shown below) US bonds have outperformed significantly overall, with only brief bouts of underperformance in the short term. There are several reasons that explain US fixed income dominance — USD strength, interest rate spreads across comparable sectors and superior corporate fundamentals. The current phase of US leadership has persisted since early 2018 but may be showing signs of fatigue at the end of the longest period of outperformance over the past dozen years. The dollar remains elevated vs a basket of major currencies compared to pre-pandemic levels, although that appears to be normalizing in recent weeks. Our view is that, as long as comparable interest rates in other major economies remain negative, or spreads benchmarked against US interest rates remain wide, global investors will prefer US bonds. We currently hold little or no international fixed income and remain positioned in shorter duration instruments. [Charts and data courtesy Bloomberg LP © 2020]