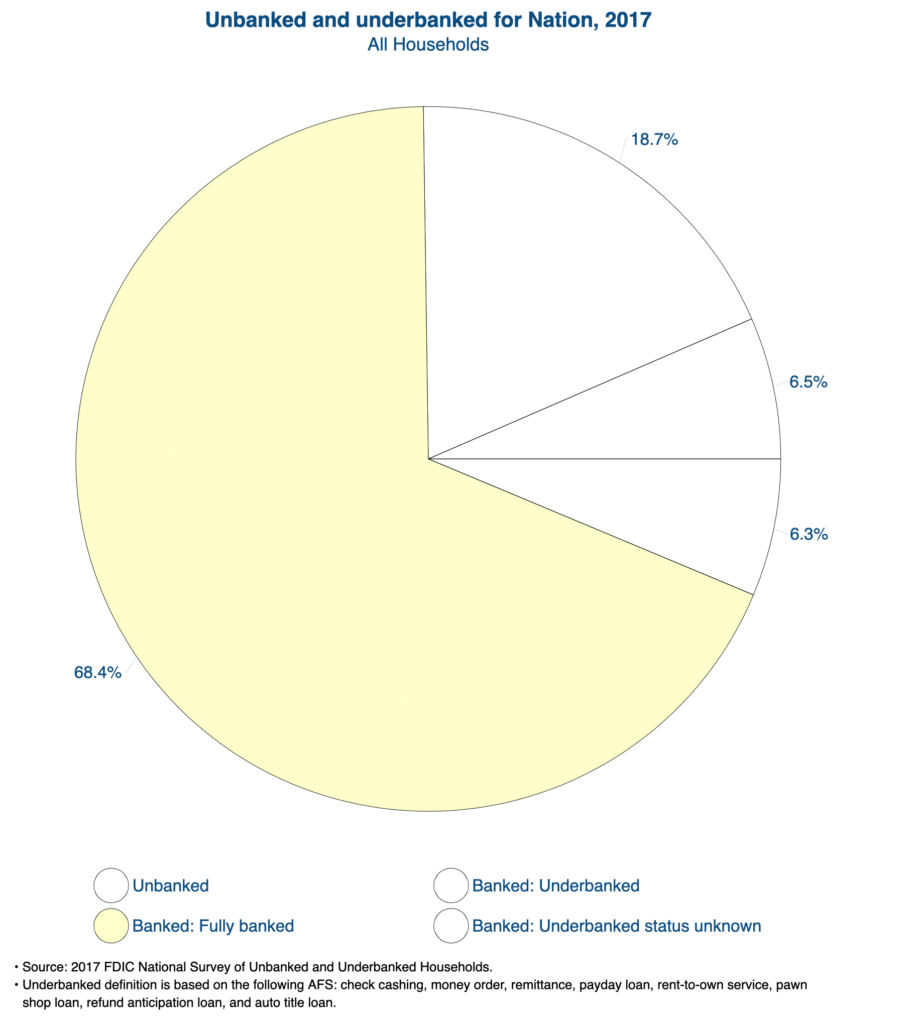

Economic fault lines run deep across America. Many of these lines have been laid bare as a consequence of the economic crisis unleashed by the COVID-19 outbreak, but the lines were there long before, and will continue long after. Those sitting on the bottom rungs of the prosperity ladder not only were among the most vulnerable as business, trade and service ground to a halt, they are in the worst position to participate in the recovery. Access to capital is critical to household and business formation, maintenance and growth. As recently as 2017, the last time the FDIC released its biennial national survey, 18.7% of American households were underbanked (relying on payday lenders, rent-to-own, pawn shops, refund anticipation loans, and other non-bank resources), and a full 6.5%, or nearly 8.5 million households, were completely unbanked. Without access to the financial infrastructure enjoyed by nearly 70% of the population, the road ahead will be difficult if not impossible, and investing in community financing through CDFIs and other non-traditional conduits will be critical to an inclusive recovery.