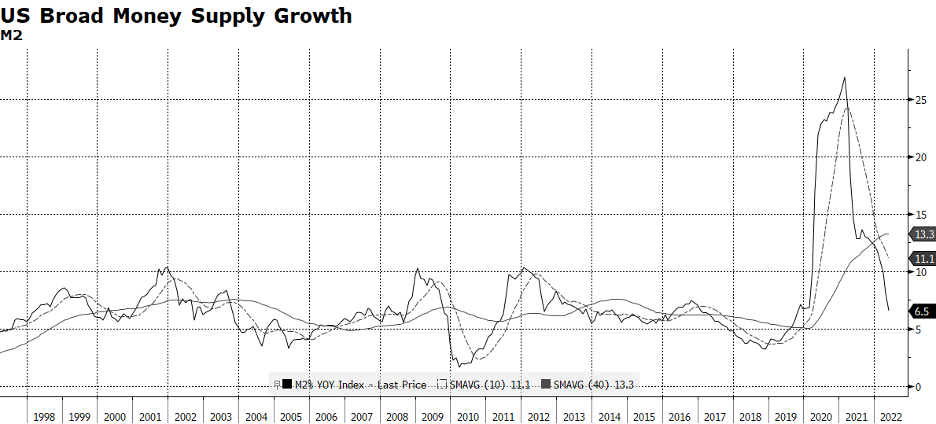

The growth in the US money supply is decelerating rapidly, which is problematic for the economy and capital markets. To be absolutely clear, the money supply itself is not shrinking – the rate of growth is. It is no secret that the US Federal Reserve is reining in liquidity by raising policy rates and decreasing the size of its $8.9 trillion balance sheet. Pre-pandemic, the Fed’s balance sheet was $4.2 trillion, less than half the current level. The reason why this is important is the Fed has largely been responsible for the explosive growth in the money supply over the past two years, which peaked at an annual pace of 26.9% in February 2021. To place that in context, the 30-year average annual growth rate of M2 is 6.4% while the current pace as of May 31st is 6.5%. But, examine the included chart. Barring the extraordinary, the current trace will crash right through the long term trend and keep going.

The 30-year average nominal US GDP growth is 4.6% according to the US Bureau of Economic Analysis. Over the long-term, M2 grows faster than nominal GDP in order to bolster economic activity, and when it slows, so does the economy. The level of M2 peaked at the end of March at $21,809 trillion, and has only grown 1.26% year-to-date. Given the receding liquidity in the US economy, it is no wonder why Q1 2022 was an anemic -1.6% (and revised down). What is critically important to us is that the Fed has been the most dominant force in money supply growth in this cycle. In more normal times, banks create money from their deposit bases, but this has been overwhelmed by the Fed’s quantitative easing programs. And so, navigating the path back to normal involves the Fed stepping back to its more traditional role.

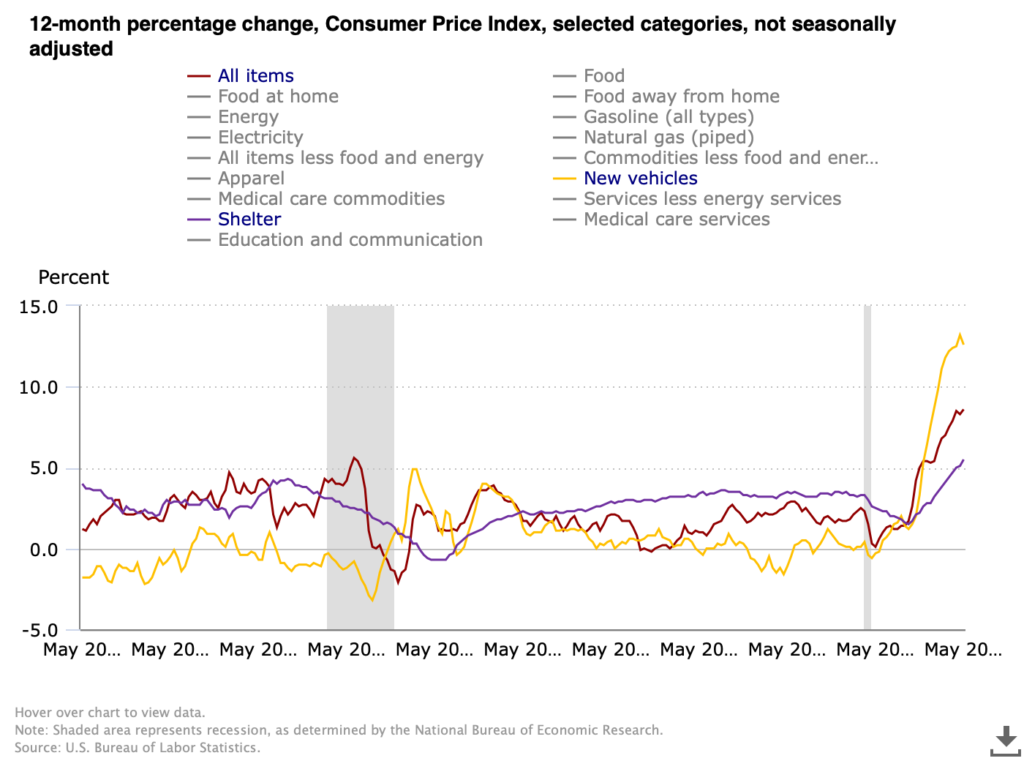

It is difficult to envision a scenario wherein the Fed engineers a “soft landing” while simultaneously reining in 40-year high levels of inflation and supporting economy and employment. GDP growth for the first half of 2022 will be reported on July 31st and we would not be surprised if another weak reading confirms that we are in a recession. Even so, the Fed has little choice but to maintain a less-than-dovish monetary stance given current inflationary trends here and abroad. [chart courtesy Bloomberg LP (c) 2022]

From the Board of Governors of the Federal Reserve System:

- M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of other checkable deposits (or OCDs, which comprise negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions) and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and other liquid deposits, each seasonally adjusted separately.

- M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (2) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing small-denomination time deposits and retail MMFs, each seasonally adjusted separately, and adding the result to seasonally adjusted M1.