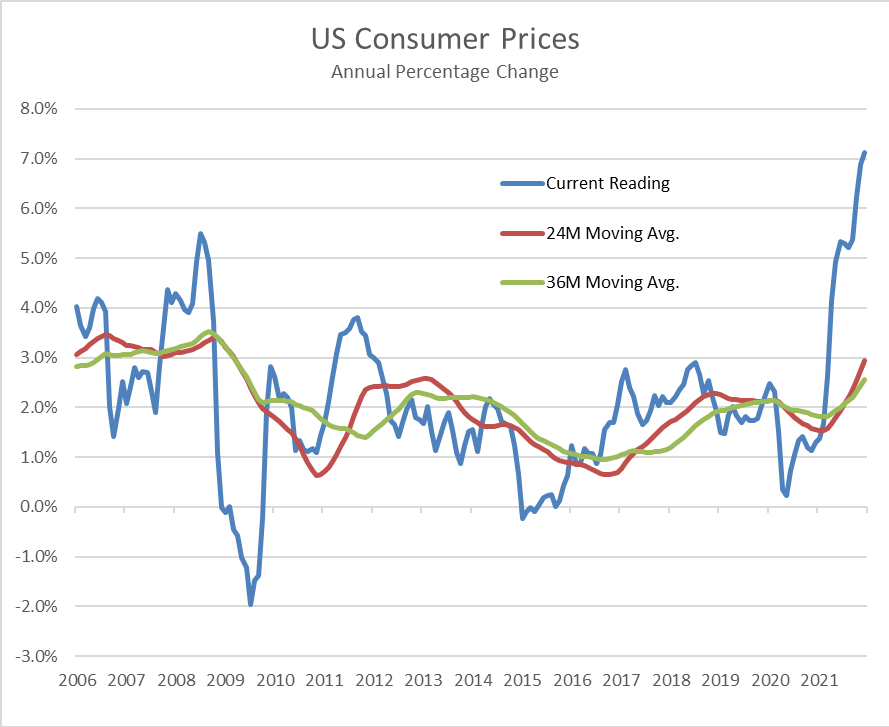

Evidence of consumer price pressure abound ranging from rising food to energy to consumer staples. Overall, US consumer prices rose over 7%, a growth rate the US has not faced since the 1980s. There are several well-documented reasons why prices have risen so rapidly, including the pandemic-forced economic shutdowns and supply chain disruptions of the past two years. How long will inflationary conditions persist, and will it become structural? Prior to the pandemic, the US was in a benign inflationary environment. Then, disinflation resulting from government-mandated shutdowns across the country suppressed prices. The annual change in US CPI averaged 1.4% from April 2020 to April 2021. The current CPI reading on December 31, 2021 is based off pandemic nadir levels, and the base effect may lead to higher “headline” inflation in the months ahead. However, if annual gains in consumer prices fail to keep pace with the high inflation trends of 2021 [which include 2020’s low base effect], forward looking inflation could moderate. Capital markets will likely remain on edge, and the US Federal Reserve will be challenged balancing appropriate monetary policy against inflationary trends that may prove temporary, but also may not. (chart © 2022 Wilde Capital Management, data from Bureau of Labor Statistics)