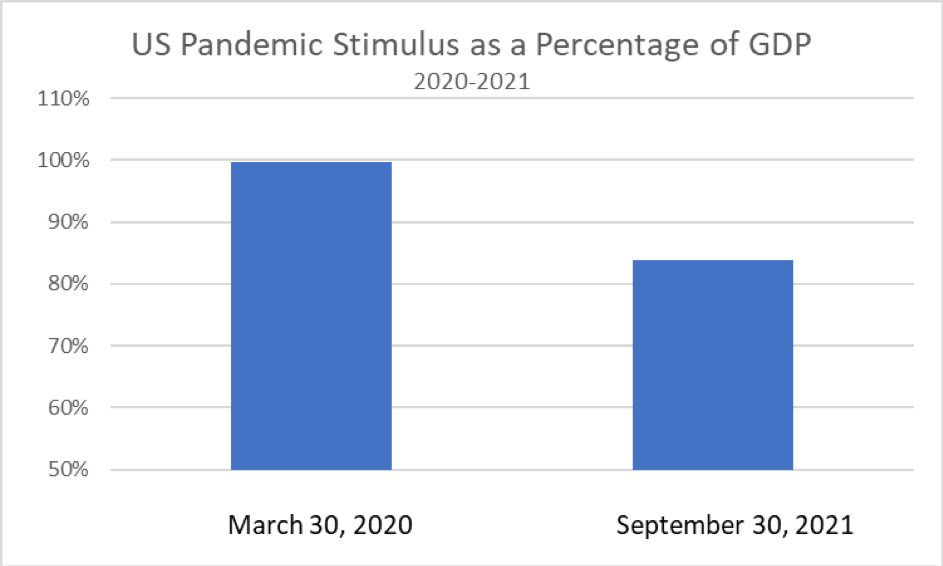

Since March 2020 the US federal government has injected an enormous amount of stimulus into the economy. There have been seven stimulus and reliefpackages ranging from the original Coronavirus Preparedness and Response Supplemental Appropriations Act to The Families First Act to the CARES Act to The Consolidated Appropriations Act and the most recent American Rescue Plan. Even without Build Back Better, this fiscal expenditure legislation amounts to nearly $15 trillion over the life of the legislation with more on the way with the new infrastructure plan. The Federal Reserve has also injected a tremendous amount of liquidity in the system by expanding its balance sheet by $4.5 trillion since March 2020 while maintaining a benign interest rate and regulatory environment. The combined government stimulus over the past twenty months amounts to over 83% of current US GDP (as of end Q3 2021). Compared to the recessionary bottom in 2020, the same stimulus is nearly 100%. By contrast, the 2009 TARP expenditure amounted to about 5% of US GDP at the time. We do not have to look far to see from where upward pressure on asset prices and inflation comes.