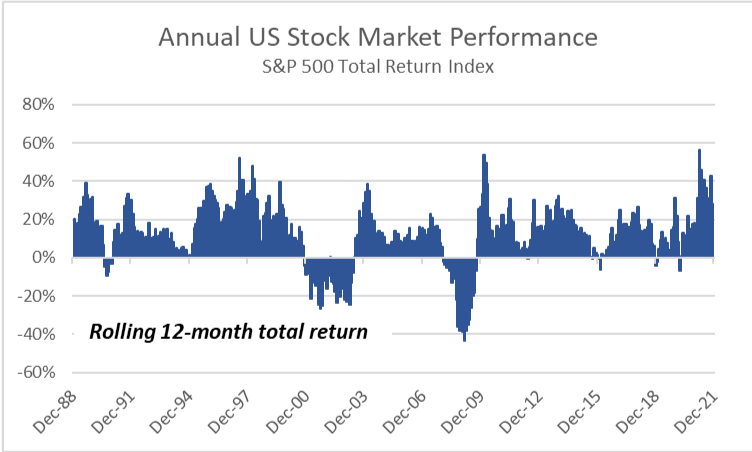

Through the end of November, the S&P 500 has delivered a robust 23.2% year-to-date total return, piling on to2020’s impressive full-year 18.4% clip. On its face, such strong stock market results would seem implausible given the disruptive forces of the pandemic, the multiple variants and building inflationary pressure here and abroad. The S&P 500 reached its pandemic bottom on March 23, 2020 and since then, the 20 month-end observations of rolling annual returns (shown on the chart) have averaged over 25.8%. To place that figure in context, the long-term average annual return since inception in 1987 is 12.38%. The low “base effect” climbing up from the pandemic bottom contributed to the relative strong % gains over the past twenty months, but there are also significant macro factors that have supported a booming US stock market that may prove to be headwinds going forward. [chart data courtesy Standard & Poors, Bloomberg LP © 2021]