The market, in our view, is trying to come to grips with a less accommodative yet still supportive monetary and fiscal policy environment. Federal Reserve policy is dominant at this moment, since it appears fiscal policy progress has stalled until the mid-term elections and perhaps beyond. The Fed is unlikely to turn away from its recent pivot towards being less “dovish”, which in light of recent inflationary trends is still is a far cry from an aggressively “hawkish” stance.

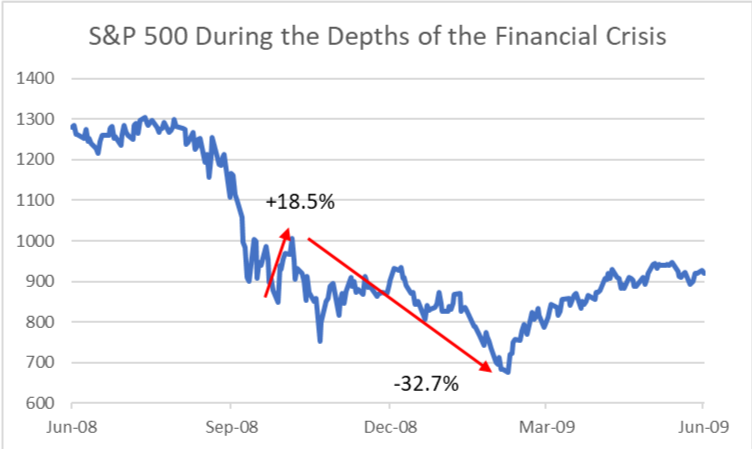

It seems probable the market will re-test the lows of January 24th over the coming days or weeks, and from there we will ultimately see from which way the equity market breaks. The recent intra-day volatility was reminiscent of some of the price action during the financial crisis, particularly around the 2008 election. When it appeared that President Obama would easily win, the S&P 500 rallied over 18% from October 27th to election day November 4th. With deep uncertainty about who would fill the new President’s cabinet and what steps they would take to address the worsening crisis, the S&P 500 subsequently fell nearly 33%. The market ultimately bottomed when Timothy Geithner, Obama’s most important new cabinet appointee at that moment (Sec. Treas.), announced the deployment of the TARP funds. There are certainly differences between 2008-2009 and now, most notably the health of the financial sector. However, the market fears uncertainty and that is a common thread between now and then. Another more tenuous thread, but one worth watching, is the speculative bubble in digital assets that has already partially ruptured, and the run-up in residential real estate in part fueled by loose lending practices. Today’s uncertainty is primarily around what the future holds in a less accommodative monetary and fiscal environment. Economic activity, while still growing, appears to be slowing and high inflation persists, prompting concerns about the potential for stagflation. [chart: Wilde Capital Management © 2022, data from Standard & Poor’s 500 Index]