The February 10th inflation report for January was higher than expected. Key stock market gauges declined and were particularly weak toward the day’s close. Notably, all major inflation segments continue to rise — Services, Goods, and Food — with the exception of Energy, but oil and gas prices are up so far in February.

The benchmark 10Y UST yield rose above 2.0%, which has been an adverse trigger level for stocks in the recent past. The real yield on US Treasuries is more than -5%, a historic anomaly. Meanwhile, the US Federal Reserve will begin reducing its balance sheet in March. It currently stands at $8.9T, increasing over $5T since the pre-pandemic low of $3.75T, about a 134% increase since the Fall of 2019. Furthermore, the Fed is set to increase policy rates several times this year, perhaps as many as six times.

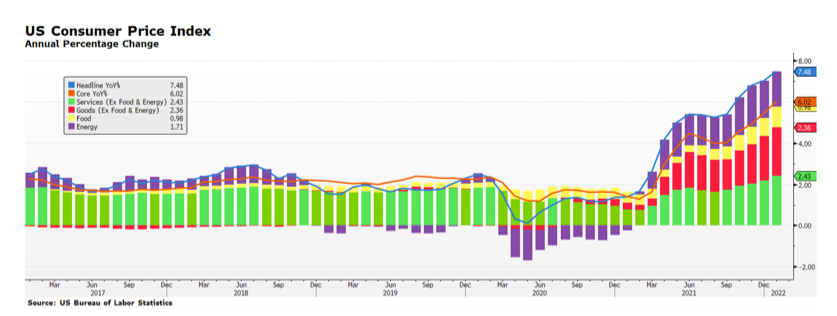

It is difficult to envision the Fed backing away from its intent to restrain monetary liquidity, especially considering that inflation trends appear to be gaining momentum. Consumer prices initially began to accelerate in March of last year, rising from 2% to about 4.5%, and had another upswing last Fall through the latest report. Headline inflation, now stands at 7.5%, a 40-year high level that very few, if any, at the Fed have had to deal with in a professional capacity.

Policy conditions are visibly changing, yet the equity market over the past couple of weeks attempted a rally from late January’s bottoms. The recent bid on US stocks could be value seekers, although the market is still fully valued if not overvalued considering a higher rate environment. It could be a response to more and more US states announcing a wind-down of COVID-era policies, or simply that capital needs a place to land and US stocks are more attractive than international equity markets or global bonds.

Absent a meaningful catalyst (we are still looking) we do not anticipate a sustained rally and expect the general trend of US equity prices to be range bound to downward. Investors must come to grips with a tighter monetary policy environment, higher interest rates and inflation. We note that other major central banks, notably the BOE, have increased policy rates, and the ECB is publicly debating the need to address inflationary trends on the European continent. And, many emerging market CBs have already embarked on a tightening cycle. [chart data from US BLS © 2022]