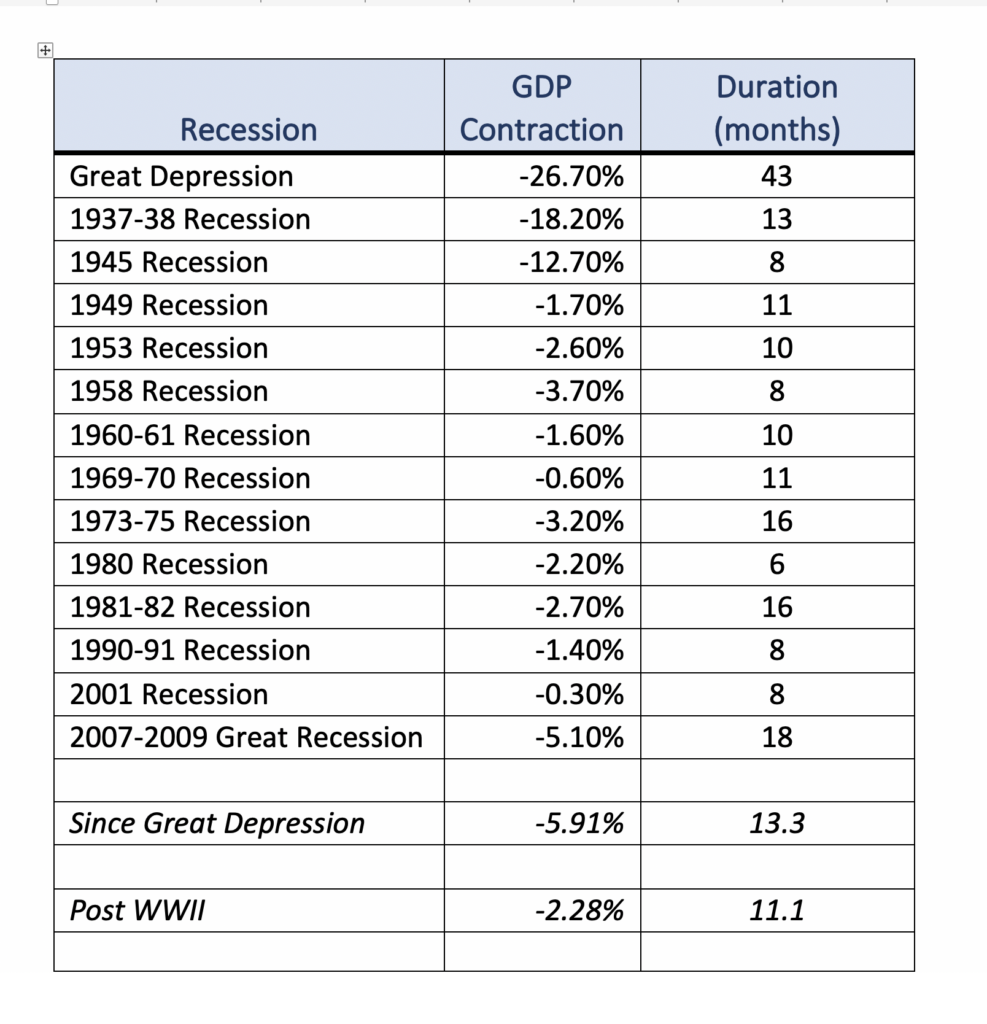

Economists are forecasting in some cases severe contractions in US GDP through the next quarter due to the impact of the COVID-19 virus. We believe that the US economy started decelerating at the beginning of March and it is extremely difficult to estimate the extent of the slowdown. America has likely never before experienced as abrupt an economic disruption. In this week’s chart (table) we have enumerated the National Bureau of Economic Research list of recessions beginning with the Great Depression. The average contraction in GDP since the Great Depression is 5.9% and lasted 13 months. Post WW II in the industrial rebound-fueled era the average contraction was 2.3%, lasting 11 months. Economists’ current forecasts range from declines in GDP growth in the mid-single digits to close to 10% from current quarter to Q2 2020. America has not realized that level of contraction in economic activity for over 70 years.

The American economy is vastly more modern and resilient than in the past and the US Federal Reserve and federal government have pledged as much as $1.7 trillion in monetary and fiscal expenditures to buttress the economy. That extraordinary amount is nearly 8% of nominal GDP. We could experience a sharp rebound as this injection of liquidity stimulates spending, a temporary wealth effect, and pent-up demand stemming from service-sector employees returning to the labor force when this crisis subsides.