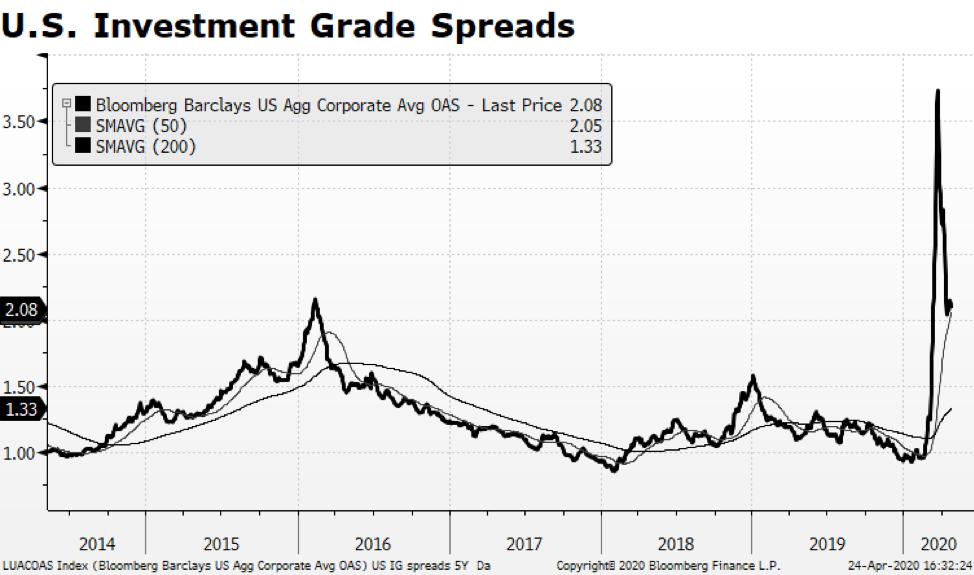

A positive development has surfaced within the US fixed income market — Investment Grade Corporate Credit spreads have narrowed relative to the 10-year US Treasury yield, yet still remain wide by historical measures. There may be some opportunity in that sector of the bond market. Even with that backdrop, oil price volatility unnerved many observers as the near-term WTI contract (for May 2020 delivery) priced with a negative sign Monday closing at a bizarre -$37.63. It has since recovered to about $17. Ongoing anemic demand combined with a lack of available storage to create a moment where there was no immediate bid for oil. From an equity market standpoint, the impact was limited though as the major integrated energy companies continued to rebound along with the overall stock market. Importantly, the sector currently stands at only 2.9% of the S&P 500 while 10 years ago it represented nearly three times that share of the index.

We are optimistic about US capital markets, but the health crisis will continue to generate grim news and adversely impact the labor market and the overall economy. This week’s first-time unemployment claims brought the running total to 26.5 million American jobs, essentially wiping out all job gains since the Great Recession. The US is far from out of the woods, but the market is handicapping a positive outcome in the long term.