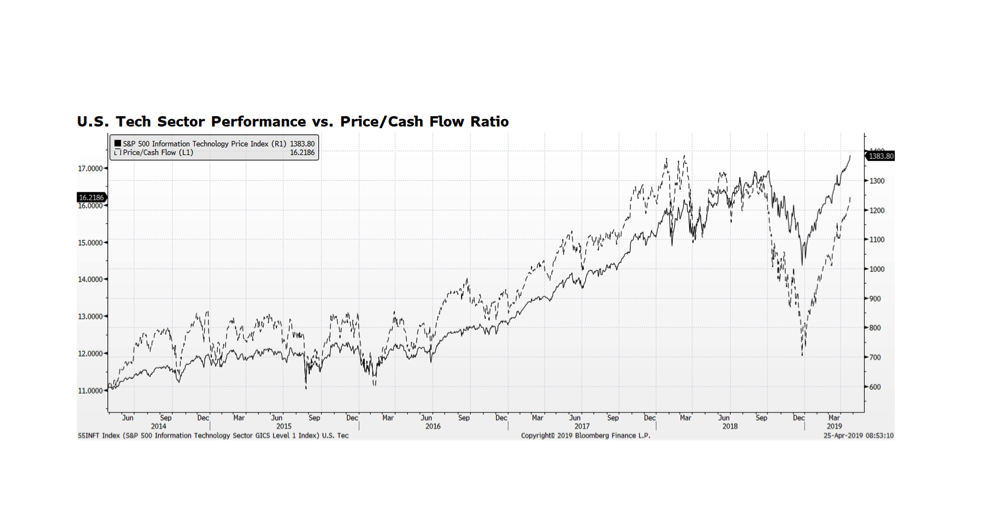

A little off-schedule so we’ll call it the Chart of the Moment. Based on Standard & Poor’s indices, the rebound in US technology stocks since the beginning of the year is an impressive 27.8% while the overall equity market has advanced 17.5% through April 24th. US technology companies play a critical role in the American economy and the sector is the largest in the US equity market based on capitalization. Further gains of US equities overall largely depend on tech sector performance and valuation readings are approaching historically high levels. We show the technology sector along with its price-to-cash flow (P/CF) valuation metric. The current P/CF is 16.2 which is below last March’s five-year high of 17.6 but still in an area where the sector has struggled. We are currently in the midst of the US earnings season, and if technology companies can continue to deliver strong earnings and cash flow, share prices should advance further. (all data citations as of April 24, 2019)