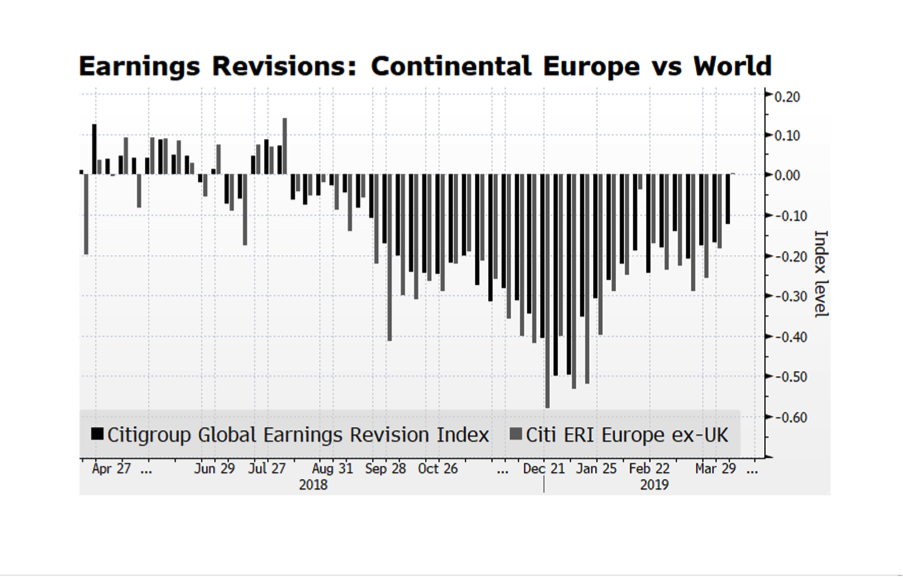

The Eurozone has faced several roadblocks to growth since the Financial Crisis ranging from the debt crises in Italy and Greece, to the uncertainty related to Brexit to stubbornly sluggish economic growth. We have been concerned that economic conditions on the Continent would strain corporate performance and therefore we have not been fully committed to Eurozone equities for quite some time even though the region has favorable valuations compared to global peers. Now there may be positive trends developing. This week’s chart shows Citigroup’s Earnings Revision Indices for Continental Europe and the Globe. The latest reading for Europe was flat while the World registered -0.12. Both indices appear to be trending towards positive revisions which could provide a key underpinning for further gains in global equity markets. If positive developments continue in the European corporate sector, investors may rotate funds into the region.