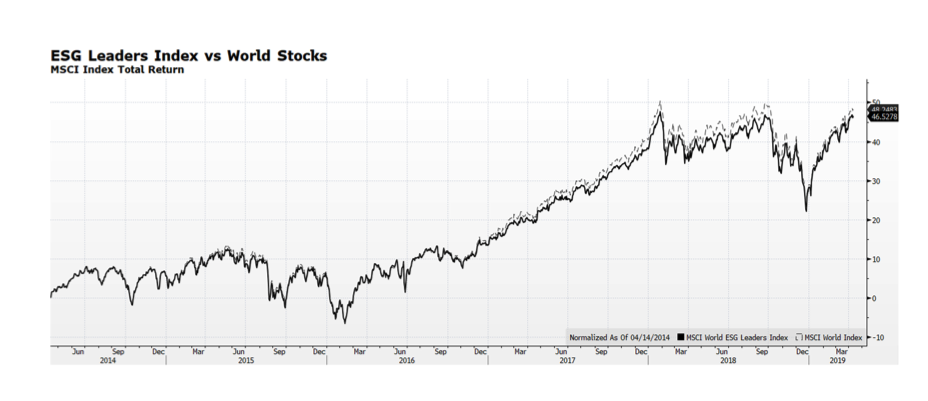

We’ve been proponents of Environmental, Social and Governance (ESG) investment disciplines going back long prior to founding WCM and it is one of our key investment offerings. A common misperception is that ESG-related investing is prone to significant underperformance due to limitations in order to achieve ESG compliance. This week’s chart shows the total return of the MSCI World ESG Leaders Index and the MSCI World Index over the past five years. Generally, the two indexes move in a similar direction and over the five year period ending last quarter the annualized performance differential is about 0.2% in favor of the broader index, but the performance differential is not persistent. This is the most naive way to look at ESG investing, but it decisively busts the myth that there is an automatic ESG penalty.