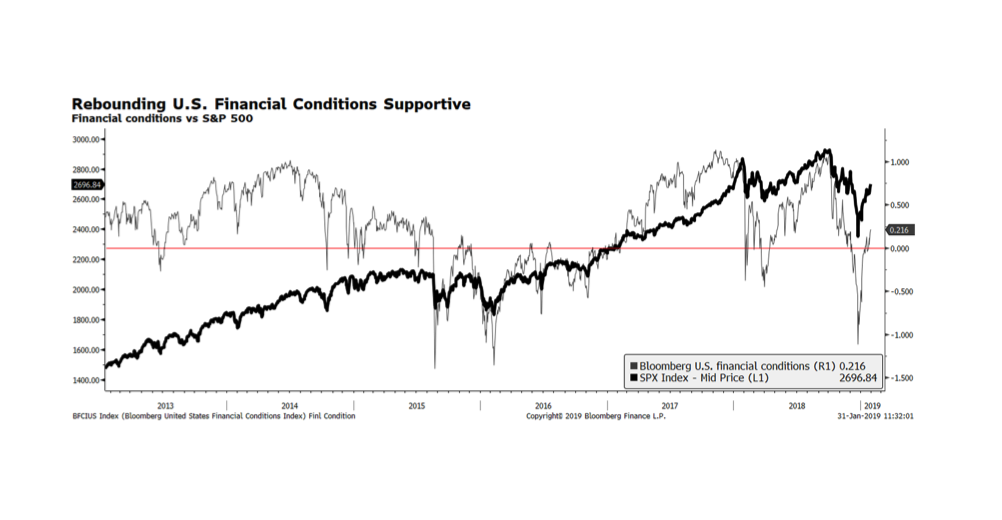

The Bloomberg US Financial Conditions Index measures the overall levels of stress in the US capital markets in order to evaluate the availability and cost of credit. A positive reading suggests that financial conditions are benign whereas a negative reading indicates a more restrictive financial environment. This week’s chart shows this indicator (the thin line plotted on the right-hand vertical axis) alongside the S&P 500 (the thick line plotted on the left-hand vertical axis). When the financial conditions index worsens or turn negative, US stock prices tend to perform poorly. The good news is that financial conditions have improved and are now positive according to this index which should be supportive of US equities and other risk assets going forward if this index can maintain positive momentum. We stress that positive financial conditions can be short lived, as shown below, causing equities to struggle. For the present, positive financial trends, attractive valuations and positive albeit slowing earnings growth should buoy US stock prices and other risk asset classes.