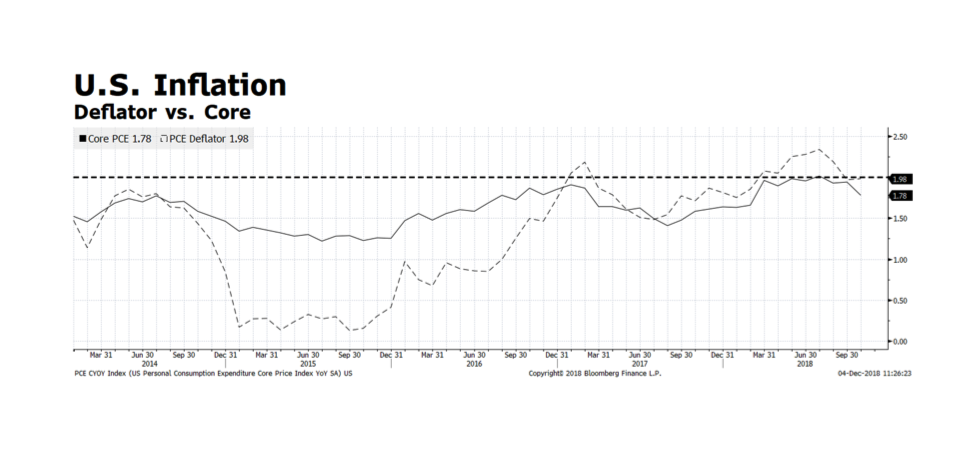

The US Federal Reserve may have greater flexibility in their efforts to manage policy rates higher due to benign inflationary trends. The personal consumption expenditure deflator has eased in recent months after reaching a multi-year high of 2.34% at the end of July. Strong economic growth, rising inflation and comments made by Fed Chairman Powell in the early Fall months that the central bank was not close to interest rate neutrality were likely significant factors in placing downward pressure on risk assets in recent months. However, last week Chairman Powell said that interest rates were “just below” neutral in a speech to the Economic Club of New York, causing capital markets here and abroad to rally before yesterday’s sharp drawdown. Other critical headwinds include the concern regarding peak corporate earnings and trade-related friction.

We still have a preference for US corporate securities over the rest of the world but are concerned that comments from US central bank leadership can produce such powerful market outcomes. An encouraging sign is market leadership is broadening particularly in the developing world over the past several weeks. A stable or weaker US dollar along with a weakening interest rate pressure could also provide a tailwind for the emerging equity and bond markets.