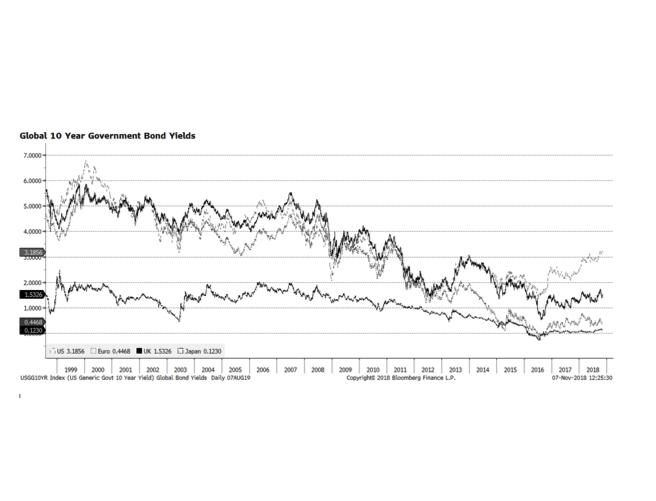

The US Federal Reserve is widely expected to continue on its pathway to higher policy rates at the December FOMC meeting. For the time being, the US economy appears that it can handle a more normal interest rate environment. Yet, economic conditions in the rest of the developed world — notably Japan and the Eurozone — remain sub-par at best and interest rates in those economies are stubbornly low. We wonder if the higher trajectory of interest rates in the US will force higher rates elsewhere internationally or will lower international rates keep US rates lower than normal. We would prefer the former because if that occurred it could happen concurrently with economic recovery in the rest of the world. This relationship is critical, in our view, because it will likely continue to influence currency and capital market volatility going forward.

© 2024 Wilde Capital Management

Theme by Anders Noren — Up ↑