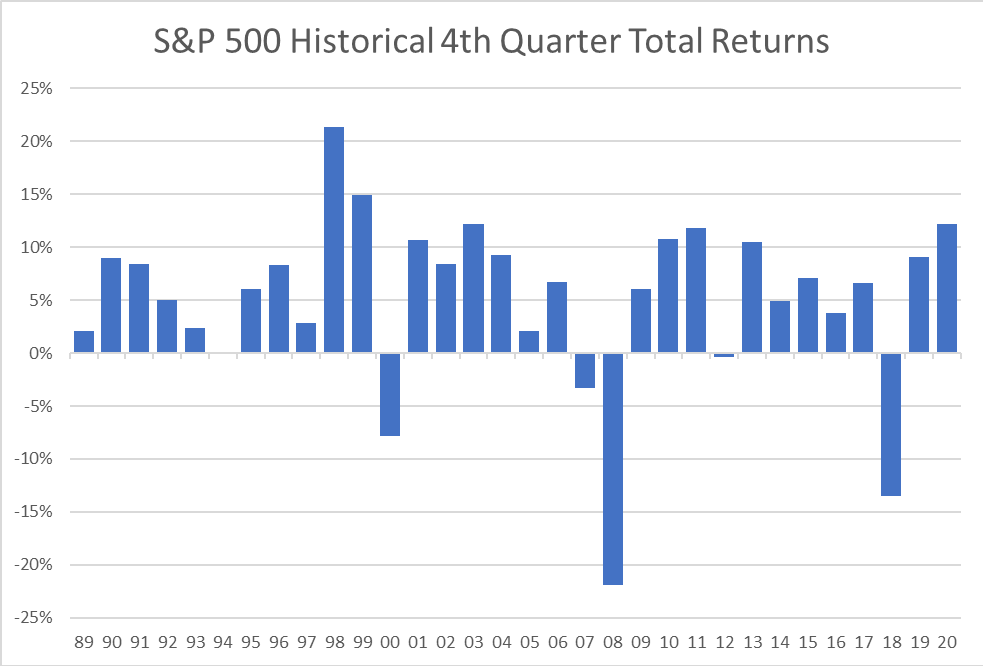

The total return of the S&P 500 tends to be positive in the final quarter of the year, averaging nearly 5.2% since Q4 of 1989. The worst final quarters of the year occurred during the technology bubble, the financial crisis and most recently 2018. Let’s look at today’s headwinds. Inflation, which is near universal across the economy, works like a broad tax on everyone. Price increases in many segments of the economy are outpacing wage growth, and that is impacting consumption which makes up about 70% of GDP. Supply chain issues will likely persist into next year and perhaps beyond, continuing to pressure prices. Next, the Fed. Their actions or inactions will be scrutinized and probably criticized for years. Tapering will start soon, but liquidity and monetary support will still be positive, just less so. It is doubtful, even with so many Fed seats open, that President Biden will appoint hawks in this environment, so we expect that will keep the Fed accommodative for longer and rate hikes pushed out further. In the Fall of 2018, our last “bad” Q4, the Fed was in balance sheet reduction mode and in the midst of raising policy rates when Powell remarked that they were “not near interest rate neutrality” causing a rout in equities worldwide. Three years and a more seasoned Powell later means we do not expect the same rhetorical mistake will be repeated. We also need to watch the ECB. Inflation could be here for longer and that would fuel ongoing volatility. Bad for bonds but not necessarily stocks. For us, even with additional volatility, equities remain the default asset class at least over the next few quarters. [chart WCM © 2021, data from Bloomberg LP]