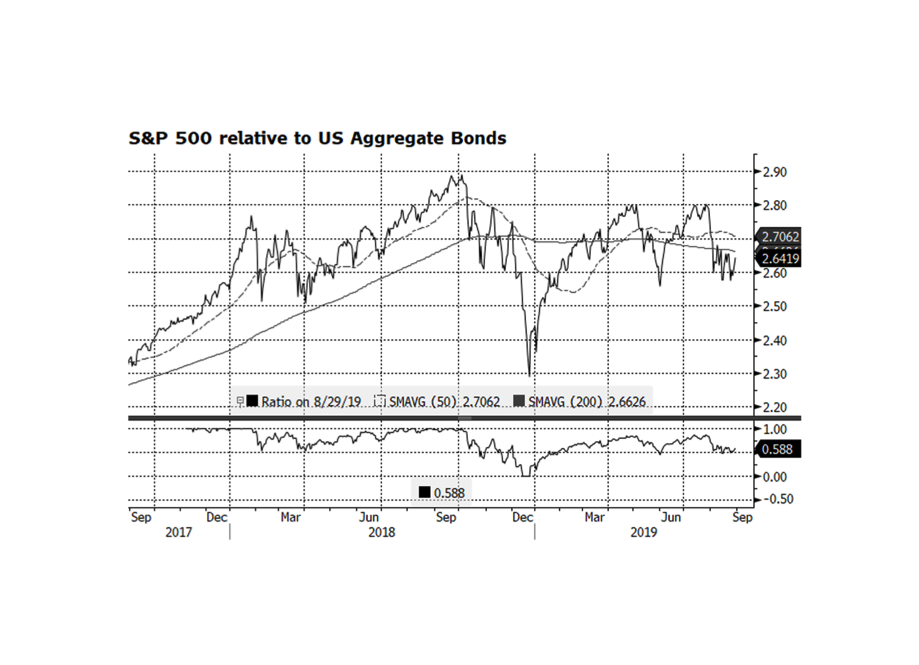

As we end the month of August US stocks have contracted 1.7% while US bonds have advanced 2.5% (through 8/29) and it seems like we have been in a tug of war between the asset classes since at least last fall. Could we be at a pivot point when investors rotate back into equities? The chart below shows the total return relationship between the S&P 500 and the Bloomberg Barclays Aggregate indices and it appears that large cap US stocks may be bottoming relative to bonds. The bond market has been supported by a benign interest rate environment as the yield on the US 10 Year Treasury Bond has fallen from 2.68% at the beginning of the year to a low of 1.47% on August 27th. There are several reasons why rates have fallen — no real inflationary pressures and lower and even negative interest rates in the rest of the developed world. If rates stabilize around current levels, equities should regain leadership given that corporate fundamentals remain solid, market valuations are not elevated, and the US economy is still expanding. [Chart courtesy Bloomberg LP (c) 2019]