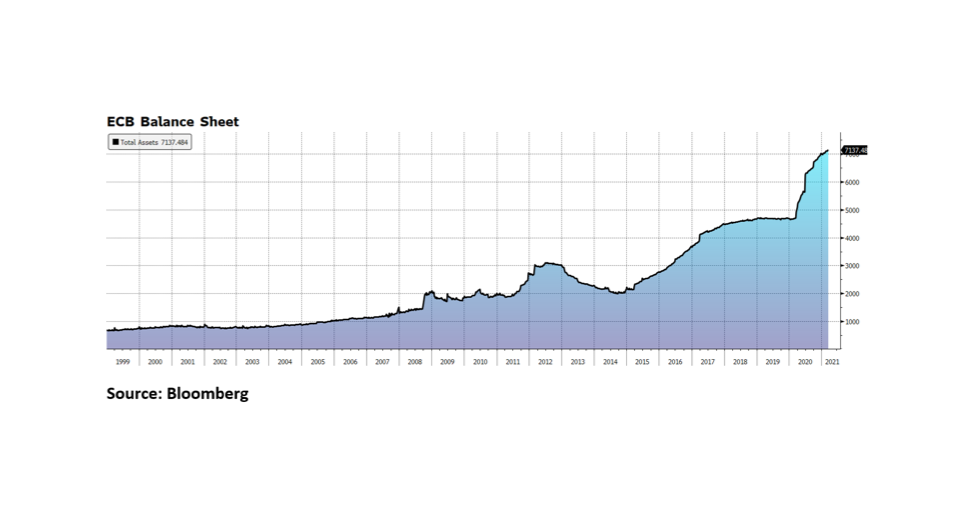

The European Central Bank’s net purchase of bonds through March 19th surpassed 21 billion Euros, the most since December, in an attempt to halt the rise in continental bond yields. According to Bloomberg, the yield on the Generic 10-year Euro Government Bond has risen from -0.67% in mid-December last year to -0.3% currently. Granted, Euro yields from 2-to-10 year issues are still negative but the pace of escalation has many concerned given the economic headwinds caused by the pandemic and the recent resurgence of infections and “re”closings. ECB President Christine Lagarde arguably faces a tougher challenge than her central bank counterparts because the EU does not have the fiscal flexibility of other major economies. That constraint may turn out to be a blessing for them as the US, for instance, implements yet another round of fiscal stimulus amounting to $1.9 trillion while the economy across the pond shows signs of accelerated economic activity.