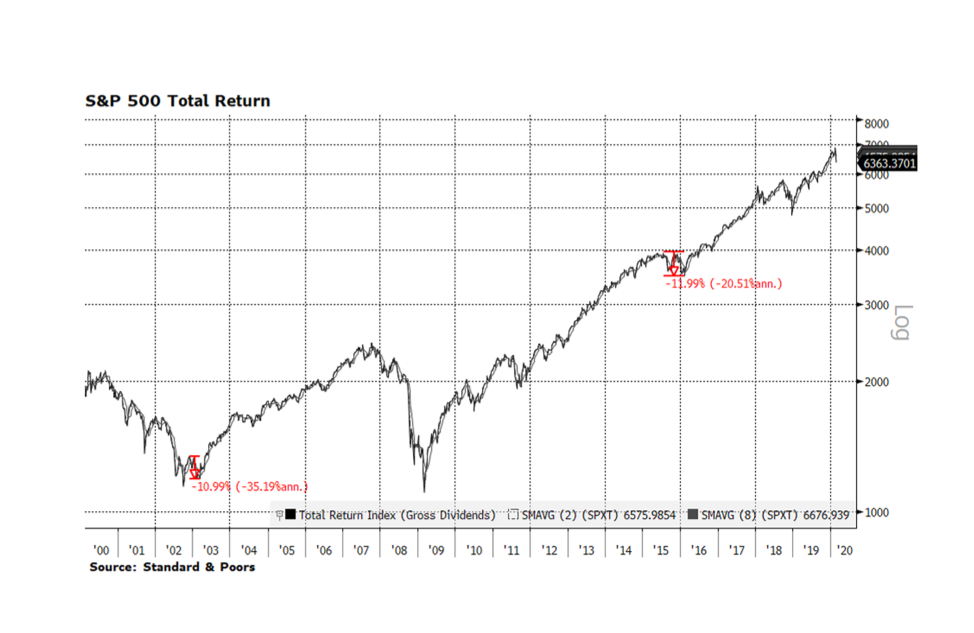

Heightened fears of COVID-19 spreading to other countries and regions over the past few days has unnerved investors and sent global equity markets lower. Since hitting an all-time high on February 12th, the FTSE Global All Cap Stock Index fell 6.4% just through February 25th. Taken in context, global stocks may continue this week’s trend. In 2003 the SARS pandemic temporarily derailed the post dot-com recovery in the U.S. The S&P 500 Total Return Index contracted nearly 11% from late November 2002 through early March 2003. The Zika virus outbreak in 2015-16 also had a similar impact on stocks as the index fell 12% from late July 2015 until bottoming in mid-February 2016. These instances are cited in this week’s chart.

The corporate environment in America is still quite strong compared to the two periods cited above and the rest of the world today. One indication can be found in credit markets where investment grade corporate credit prices continue to grind higher in the midst of stock market volatility. The toll on the human condition is tragic but our sense is that this will pass in time and may turn out to be shorter in duration due to advancements in biotechnology. That is certainly our hope but in the meantime equity markets will likely continue to be volatile. [Data courtesy S&P, chart courtesy Bloomberg LP © 2020]