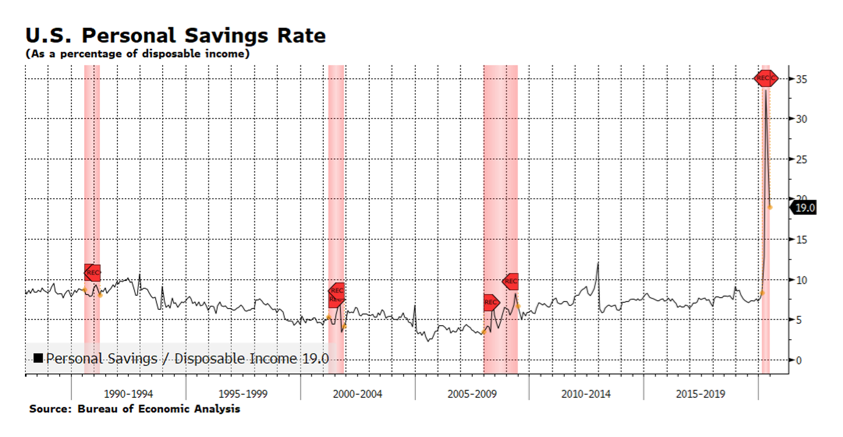

According to the Bureau of Economic Analysis, Americans are saving their disposable income at unprecedented levels. The savings rate is persisting well above previous peaks reached during recessionary periods spanning nearly 35 years. Americans are sitting on their wallets for obvious reasons – fears of the coronavirus, government mandated lock-downs and broad feelings of economic insecurity. The overall rate, while declining steadily since its April peak of 33.5%, stands at a level that is two to three times the percentage of previous recessions. That suggests to us that there is pent-up demand that could help bring the economy out its current nadir. Personal spending has been rebounding, with June’s monthly figure climbing 5.6%, building on May’s 8.5% advance. We call attention to the fact that the June report beat expectations while May was revised upward. There is still a tremendous amount of uncertainty related to COVID-19, terrible stress in the labor market and the upcoming national elections in the US, but the American consumer is a powerful economic force that may prove to be spring-loaded. [chart courtesy BEA and Bloomberg LP © 2020]