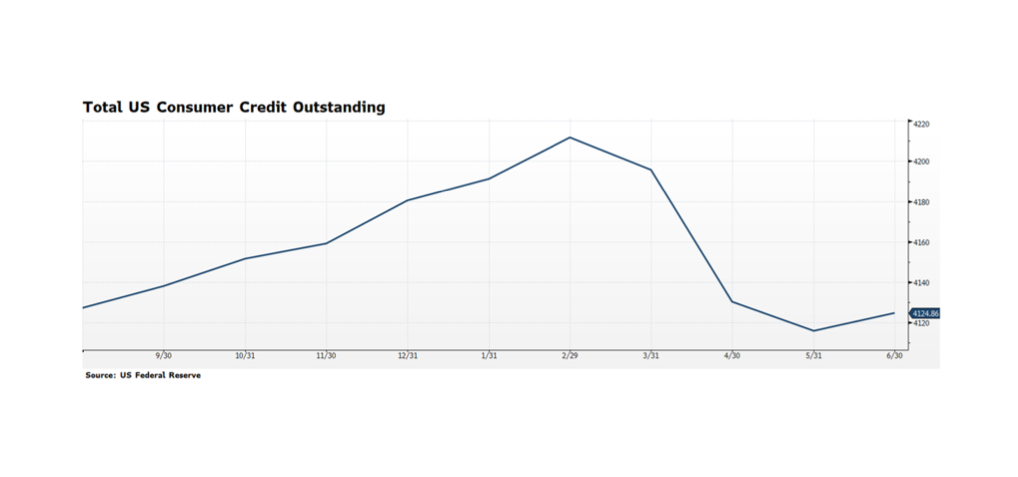

A few weeks ago we discussed US consumer trends, citing the elevated personal savings rate as reported by the BEA, in addition to citing expanding personal consumption. The relatively high personal savings rate suggests that there could be pent-up consumer demand to put that money to work. This week’s chart highlights total consumer credit outstanding, which has declined considerably since its pre-pandemic peak at the end of February. The decline in personal balance sheet leverage suggests that American households can access credit as needed or desired. This data is not very timely as June 30 is the most recent report, but it does suggest that the consumer is not as distressed as in previous recoveries.

The labor market continues to be the most restraining issue facing the economy — 14.8 million continuing jobless claims with initial claims amounting to 1.1 million this past week. But, the Bureau of Labor Statistics reported July payroll jobs expanded in 40 states, declined in one and were essentially flat in the remaining nine. We do need a broader and more inclusive jobs recovery because, as the BLS reports, the large increase in average hourly earnings is not good news — It reflects lower-paid workers being pushed out of the work force due to COVID-19 related business suspensions and closures. Strengthening trends in housing and manufacturing should spur further job growth and help restore this disenfranchised segment of the workforce. [Chart courtesy US Federal Reserve, Bloomberg LP (c) 2020]