Over the last several months we have cited several factors that, in our view, explain why the US stock market indices have been rising and may continue to do so. The most significant contributors are measures being undertaken by the US Federal Reserve and Federal government to support the labor market. The US consumer has been responding by increasing consumption, and so we see core components of the US economy like auto purchases and manufacturing rebounding. The official unemployment rate is still terribly high, measuring 10.2% in July, but that is a significant improvement over 11.1% in June.

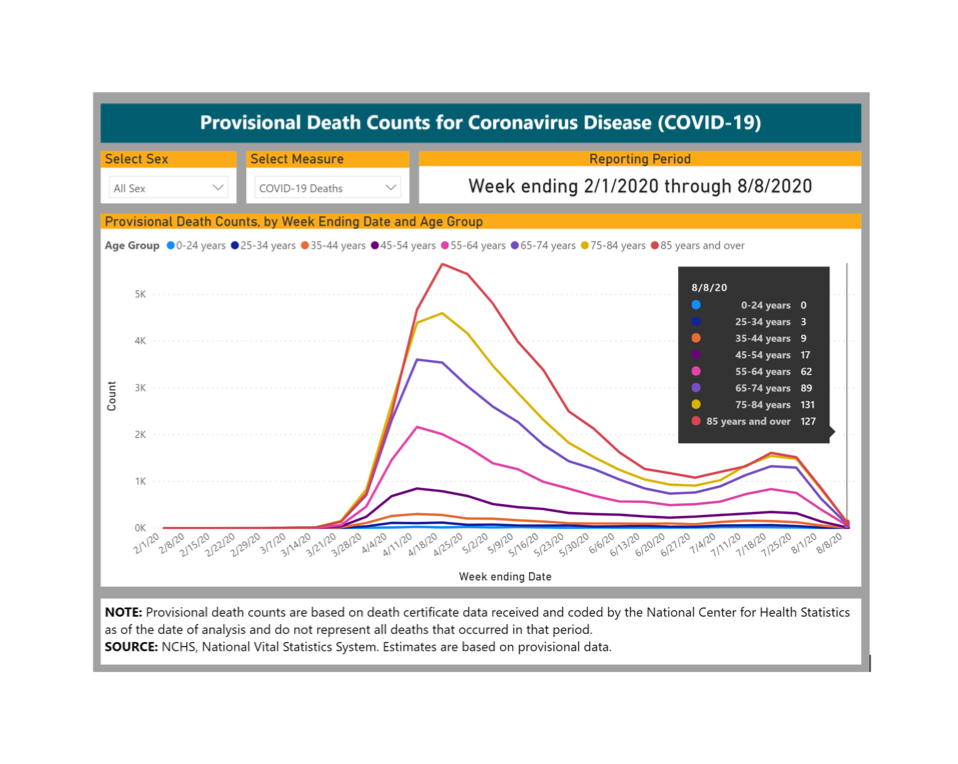

Pandemic-related government-mandated lockdowns are being lifted (although in some areas of the country those being reinstituted) and economic trends should continue to improve as people return to work and to consumption. Critically, there are encouraging signs related to COVID-19. According to the National Center for Health Statistics (part of the CDC), weekly total provisional deaths as of August 8th registered 438, lower than the pre-surge figure registered on March 21st. These totals are significantly lower than figures cited by media outlets and Johns Hopkins University, a consequence of how deaths are verified and reported, but most importantly we are seeing improving trends regardless of methodology, and that is a relief. Very well known yet still necessary to point out, this week’s chart demonstrates the concentration of fatalities for those age 55 and older, showing the terrible risk to and impact on the elderly. But, by contrast, the low concentration and declining trend among the young may alleviate concerns about the upcoming school year and broadening re-openings across the country.