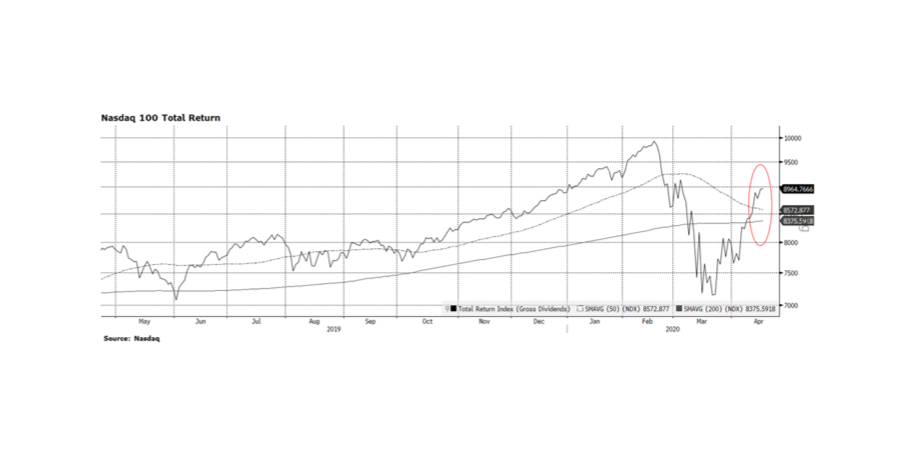

We continue to see encouraging signs in the US stock market as the three main indexes, the Dow, S&P 500 and the NASDAQ Composite have come off of their recent lows on March 23 and are making higher highs and higher lows – a key bullish technical pattern. Wednesday was interesting because the S&P 500 closed at a higher low even though it fell 2.2% for the day, and Thursday we had a modest follow through gain of 1/2 of a percent or so. The Nasdaq Composite was even more consequential because we continue to see higher highs after higher lows as well. And, in this week’s chart, the Nasdaq 100, laden with many of the US’ most innovative companies, is now positive in 2020 (still below its Feb peak) and at levels above its long-term trend lines.

We are optimistic about US stocks but the recovery in our capital markets remains fragile. As we have discussed previously, we have to separate the market outlook from the very real emotional human and economic toll this pandemic has taken across the world and in our communities. We believe that a great reawakening will occur that makes us all realize the we need key elements of our economy to be permanently secure and sustainable. US companies stand to benefit, as do American workers, from repatriation of productive capabilities in vital areas like medicine and protective equipment. Long term, we expect the marginal global investment dollar will likely be invested here in North America. [Chart courtesy NASDAQ and Bloomberg LP © 2020]