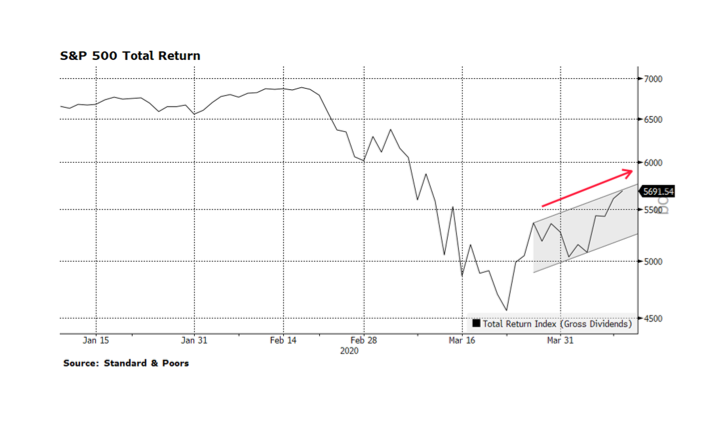

Over the past week we have witnessed encouraging signs in US equities as the three main indexes, the Dow Jones Industrial Average, the S&P 500 and the NASDAQ Composite have come off of their recent lows on March 23 and are making higher highs and higher lows – a key bullish technical pattern. We are optimistic about US stocks but also understand that we are quite far from containing this health crisis and the recovery in our capital markets remains fragile.

The rout that began in earnest late February has arguably been exacerbated by State and Federal government-led virus containment efforts — business, school, recreational closures as well as encouraging social distancing — that have effectively suppressed the economy. Throughout history recessions, depressions and bear markets were caused by bubbles bursting like Asian currencies, Dotcom companies, US mortgages, and not by intentional government economic restraint. Government intervention normally supports economic activity.

Along with roughly $1.8 trillion in asset purchases and other stimulus from the Federal Reserve, The US Federal Government has approved and is now implementing the $2.3 trillion CARES Act directly supporting American families, small businesses and larger corporations. An important aspect of the package is the speed that funds will be sent directly to citizens, anticipated to be just a few weeks. This is critical considering that over 16 million Americans have filed for first-time unemployment assistance in the past three weeks alone.

Taken together, monetary and fiscal policy stimulus surpasses $4 trillion being injected into the American economy which could represent greater than 20% of GDP. At the same time, large swaths of the US economy remain virtually frozen as COVID-19 infection rates peak. There is nothing in modern history like this tension between top-down support and restraint to compare and judge an outcome, but in the longer term we believe support will win out. [Chart courtesy S&P and Bloomberg LP © 2020]