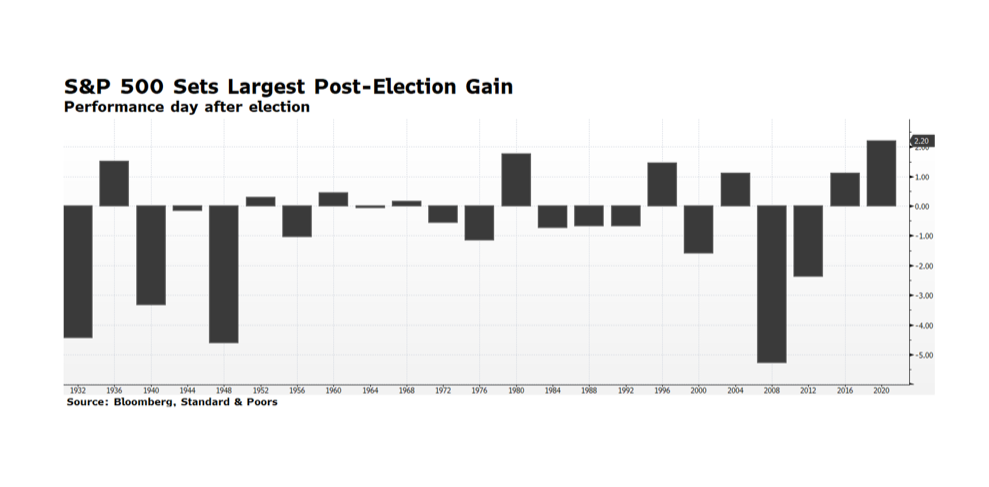

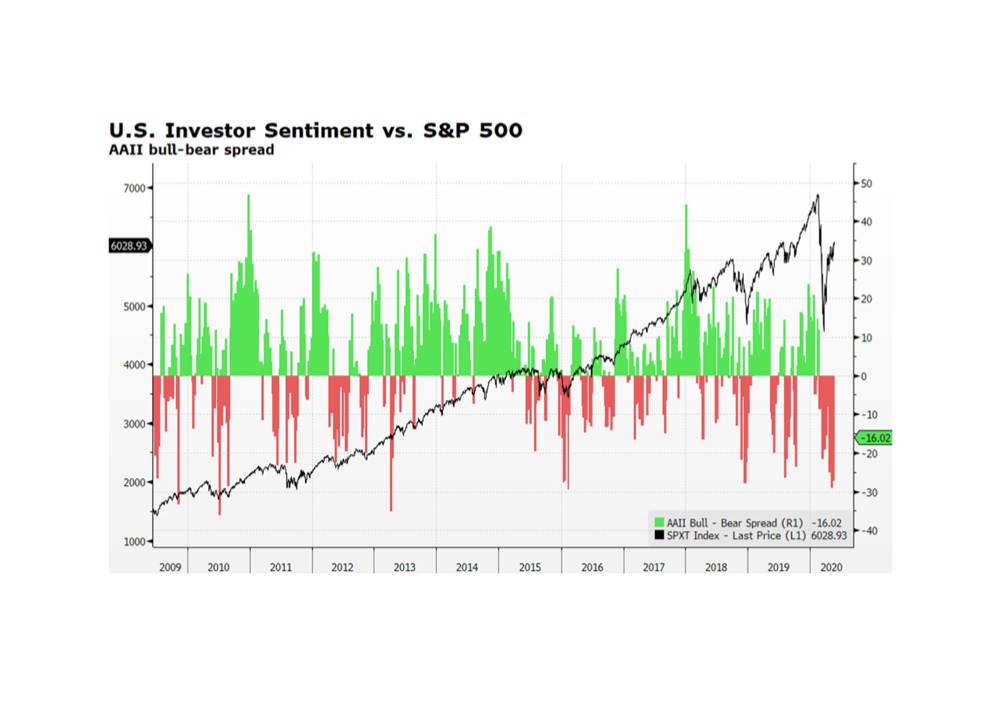

US equity markets have rallied strongly in the days following the national elections. According to Bloomberg, the S&P 500 delivered its largest day-after-election gain in history — 2.2%. This may seem perplexing because the outcome of the presidential election and even some congressional seats are yet to be finalized and markets generally fear uncertainty. It appears that Democrats will maintain control of the House of Representatives and the Senate will remain under Republican leadership while both majorities will likely be less dominant. The Electoral College does not cast its 538 votes until the first Monday following the second Wednesday in December (Dec. 14, 2020), and a lot of work is yet to be done and lawsuits to be filed in battle ground states between now and then. In light of the political uncertainty the positive tone in US equity markets can be explained by several factors.

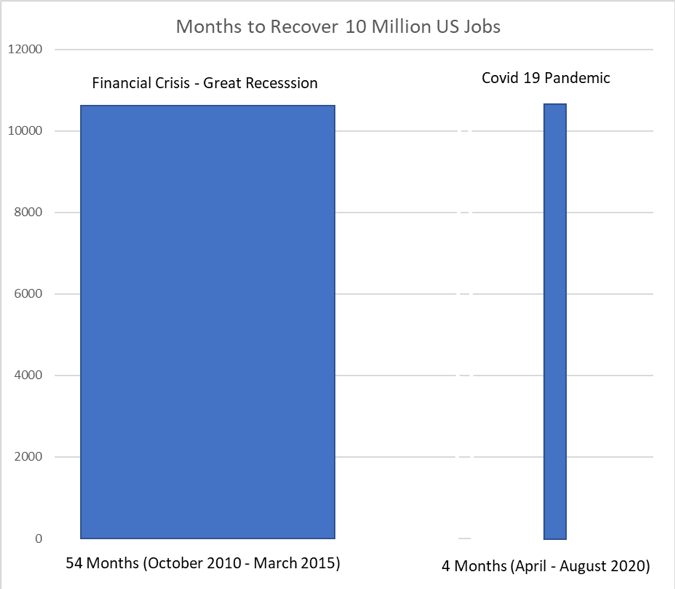

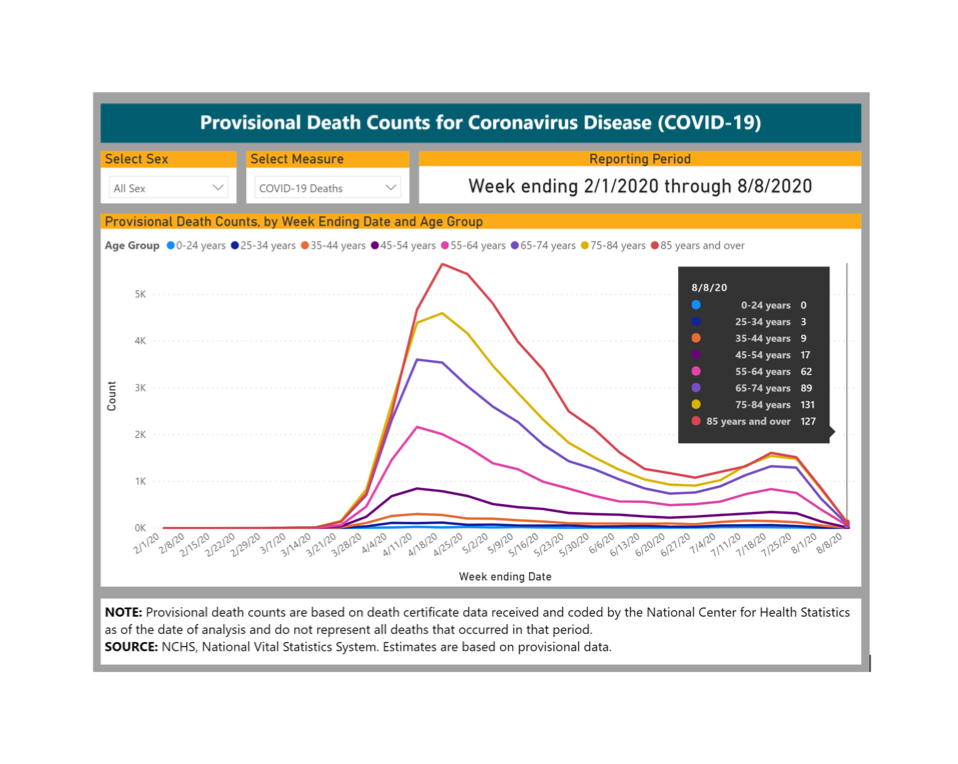

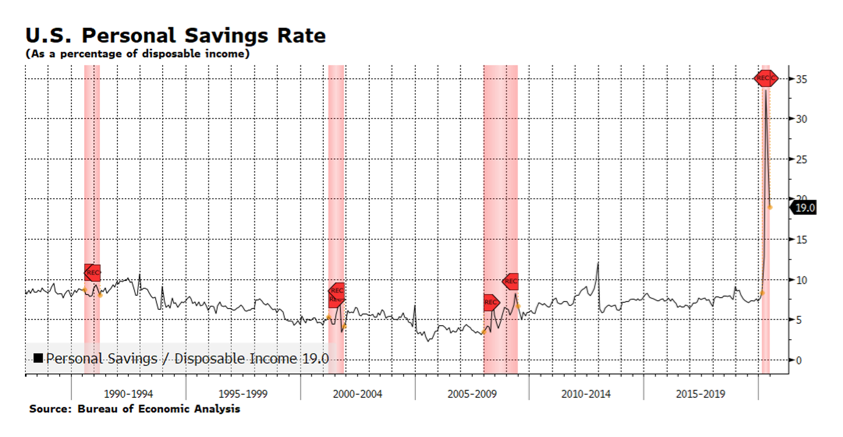

First, the balance in Congress is likely to lead to no drastic change in US tax rates as any proposed increase would stall in the Senate. The same would likely result from any major proposed change to US energy policy. Markets generally respond favorably to policy certainty, or at least stability. Second, another round of stimulus will likely be delivered at some point before the end of the year. This tranche of spending or relief will likely be more targeted to the areas of the economy most impacted by the deadly effects of COVID-19. Meanwhile the Fed will remain accommodative. Markets thrive with generous stimulus. Third, the US economy is rapidly recovering. As many expected, the US economy rebounded strongly in the third quarter, exceeding economists’ forecasts. The BEA reported GDP grew at a 33.1% annualized rate while the consensus estimates stood at 32.0% prior to the announcement. Finally, the labor market continues to improve with October employment posted as a +638,000 change in payrolls and unemployment falling to 6.9%, both better than consensus expectations.