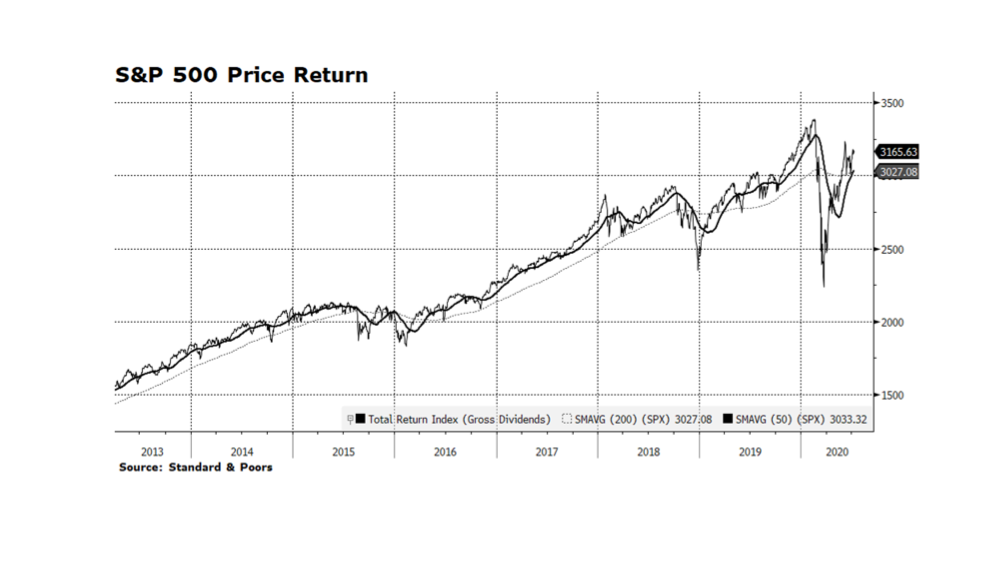

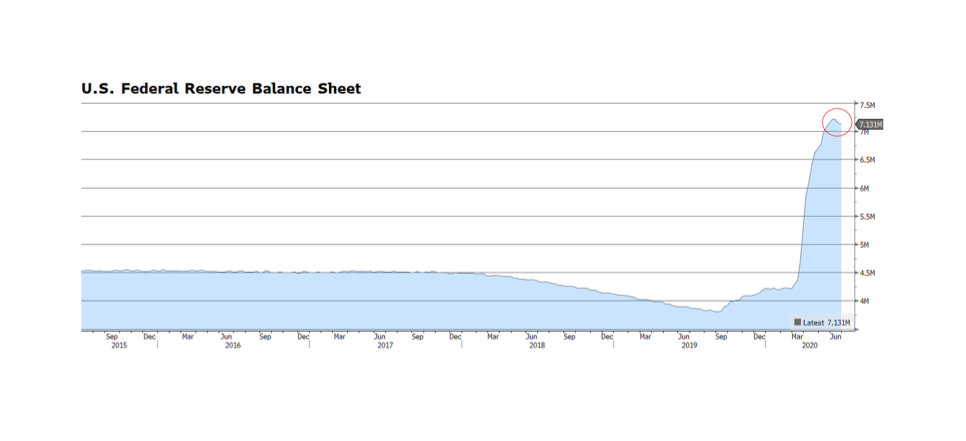

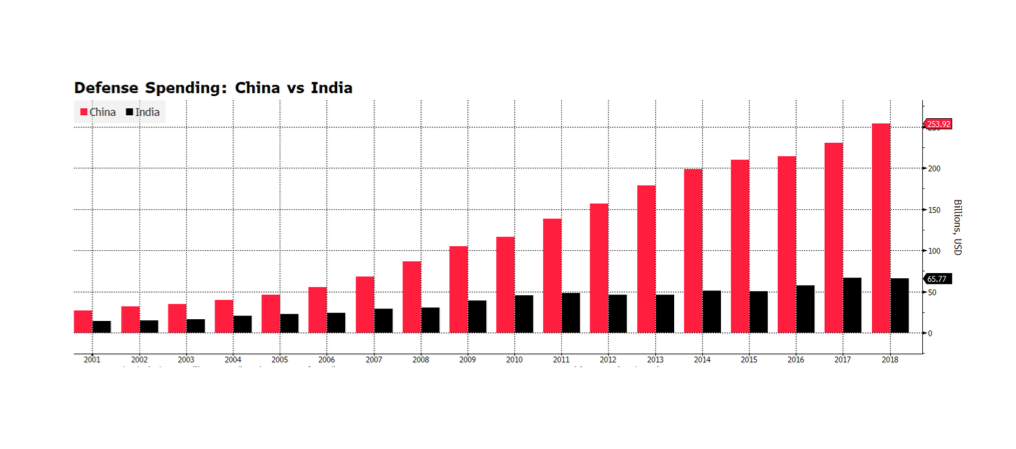

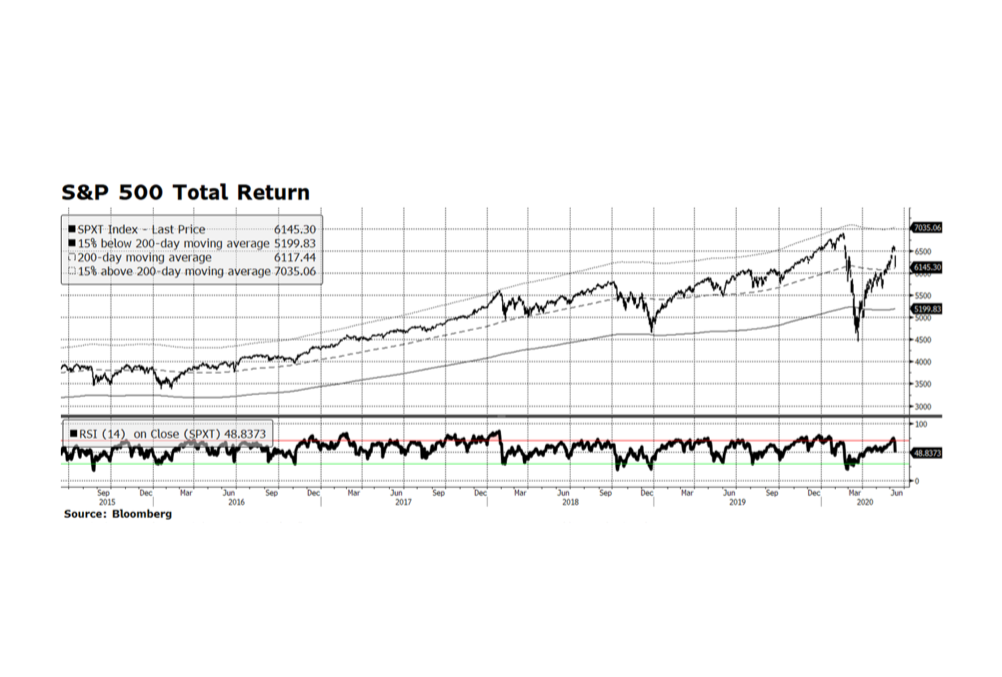

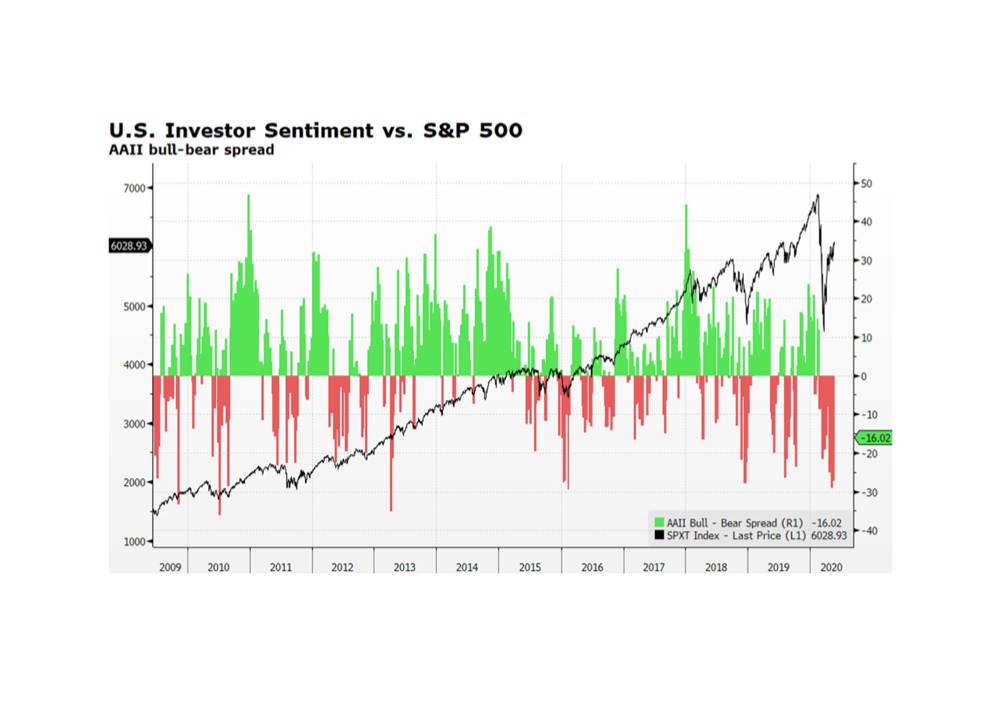

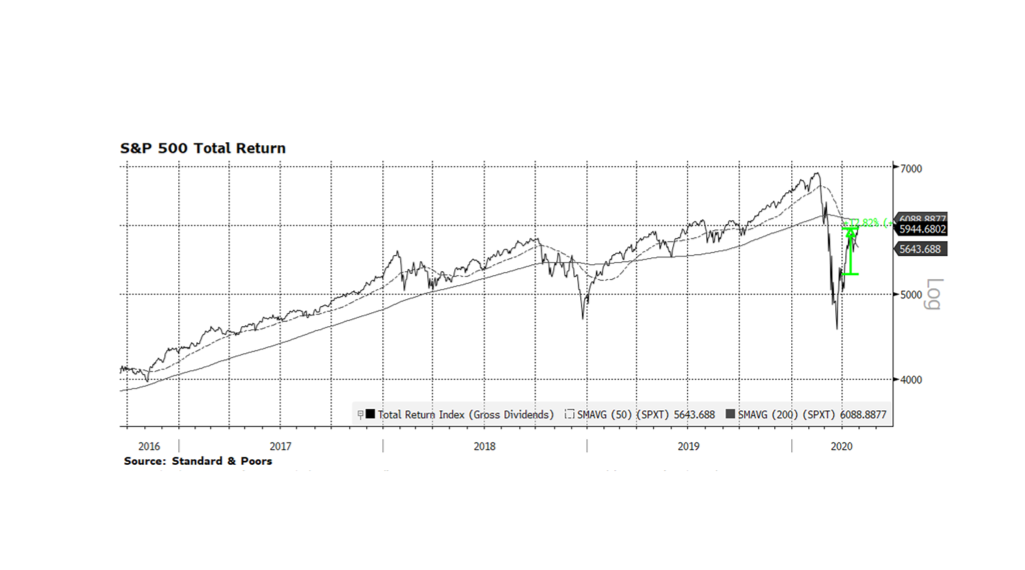

Equities in the US have been rallying since late March. The total return of the S&P 500 is 41.7% from the crisis trough on March 23 through July 9. The recovery in stocks has been among the swiftest in history and has caught many market participants underinvested during this uncertain pandemic period. Even with tremendous stress in the labor market, the overall economy and current corporate earnings, the S&P 500 price level has produced a widely followed bullish technical pattern know as a “golden cross” after Thursday’s close. This formation occurs when two key trend lines, the 50-day and 200-day moving averages, intersect while trending upwards. Generally, this condition needs to be supported by other factors, such as the powerful fiscal and monetary stimulus which we have been highlighting for the past several months, as the main reason markets have been rebounding. Another positive development is influential investment research organizations have begun to increase corporate earnings expectations for 2021. There are still well-known risks including the ebb and flow of the global pandemic and China-related tensions with the rest of the world. We expect volatility in the capital markets emanating from these and other factors, but equities, particularly in the US, will grind higher. Chart courtesy Bloomberg LP and Standard & Poors (c) 2020.