In these last hours before the US markets open for this week’s sessions, here are a few more thoughts we have shared in our community.

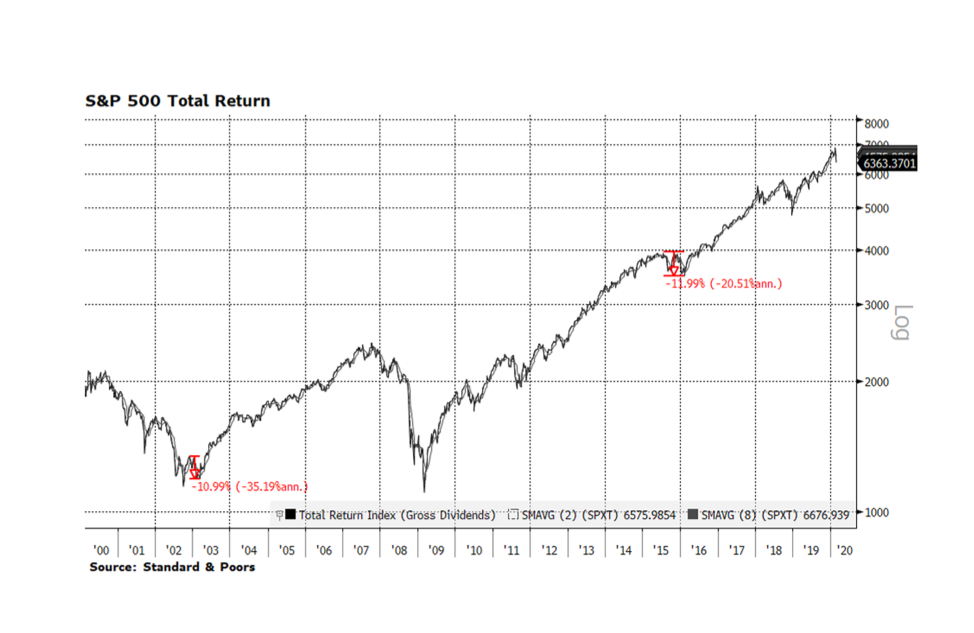

Global markets finally caught up, in the negative sense, to China’s stock markets as worries about the COVID-19 “novel” coronavirus spread to the developed West faster than the disease itself. A contagion of concern overtook markets and left us with a week of returns we have not experienced since the Financial Crisis in 2008. What is materially different from our perspective is that this correction is not a response to a lack of faith in the system itself. During the Crisis, securities prices collapsed on the fear that it was actually impossible to value many of them, and that large parts of the system were in fact worthless. In certain cases this did prove to be the case as a sudden disappearance of liquidity exposed a large quantity of bad loans and mortgages that had been ingested by major financial institutions, causing the collapse of systemically important operations like Lehman Brothers, Bear Stearns, Washington Mutual and Countrywide. There was absolutely widespread panic that we could be facing a new Great Depression as the financial system itself seized.

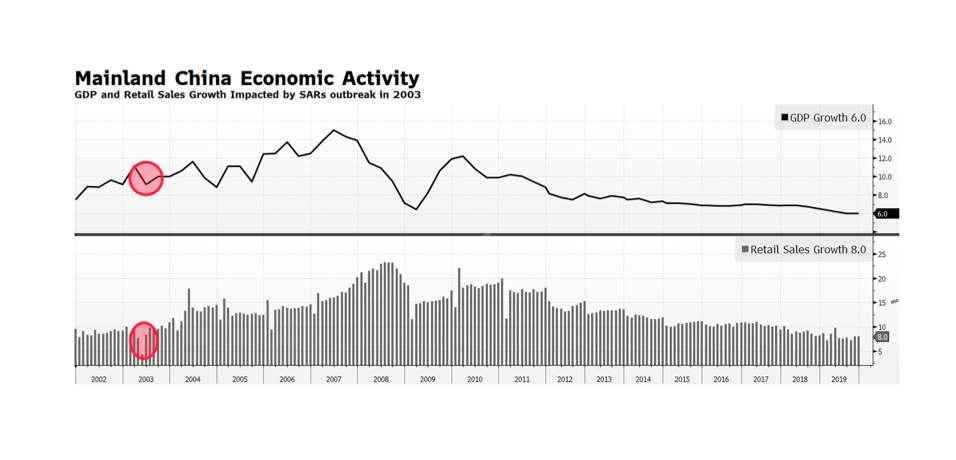

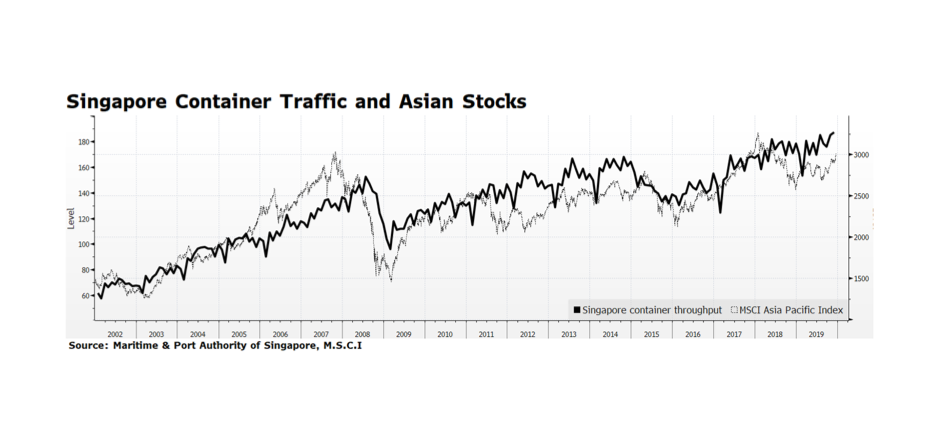

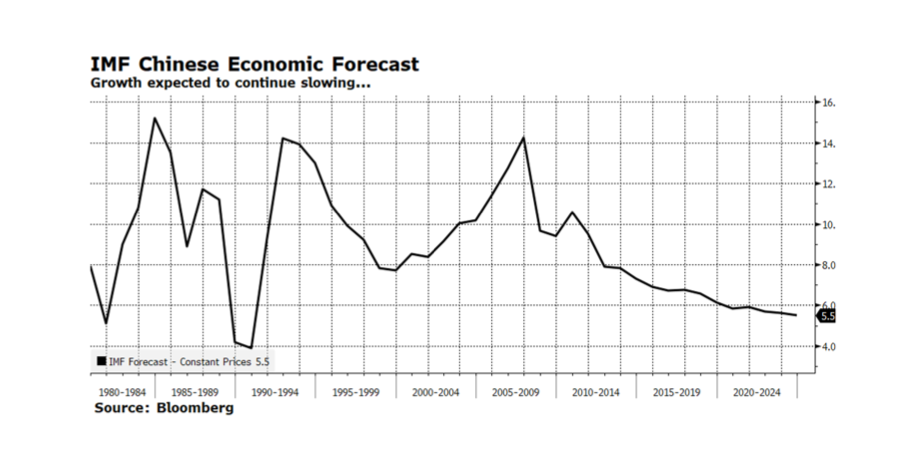

This past week was very different. As we have previously explained, COVID-19 of course has and will continue to have economic consequences, but it does not call into question the soundness of markets, banks and whole economies as we experienced a dozen years ago. We find it likely that the response to the virus will impact company earnings and the GDP of nations. Shutting down the 2nd largest economy (China) for weeks if not months would never have gone unnoticed and unpriced. Reasonably, that demands revisiting what companies are worth and whether yesterday’s prices reflect tomorrow’s realities. Prior to the outbreak, fundamentals were reasonably solid around the world. Not boom, but certainly not bust. The situation we find ourselves in could take that optimism down to modestly solid, or perhaps slightly weakened. But even a mild global recession triggered by this moment does not call into question the fundamental underpinnings of finance and commerce. We are seeing steep and sudden drops in stock markets that remind us of 2008, and nearly unprecedented lows in interest rates, without anywhere near the breakage that brought about those kinds of corrections historically.

So, in a word, why? We see a few different forces at work which all feed our collective response to unconstrained uncertainty. Emotion, namely fear, is always a powerful motivator. Fear of the virus, fear of losing money, reasonably make people want to be safe. 2008 still looms large in the minds of investors and a PTSD-type response is not out of character. Fool me once, shame on you. Fool me twice, shame on me.

That emotion is being fed by a toxic brew of real, or worse, real but incomplete, data without framing or context, and quite a lot of false narratives. Add to that the markets are now patrolled and exploited by algorithms and artificial intelligence engines that can actually capture and quantify shifting sentiment and strong moves one direction or another in prices, and exploit or even amplify or aggravate those moves for profit. We have seen numerous isolated examples of this played out in the “Flash Crash”, the “Fat Finger”, and other moments over the last many years which show how quickly and to what extremes things can break loose on little information or bad information. Throw something at the market like the novel coronavirus and we could experience those types of extreme (over)reactions again and again.

We anticipate that clarity and greater understanding around the virus’ pandemic qualities and impacts will help markets firm up, and would not be surprised to see a fair price for securities settle at something less than the peaks from just a couple weeks ago after accounting for the drag from lowered economic activity. It is also our expectation that we will see some manner of coordinated global response across the major central banks to compensate not for falling stock prices but for potential lost GDP from less commerce, less travel, and less work. Depending on the magnitude of the response this could put a floor in prices, or at least slow the descent and tamp down volatility while investors regain their footing.