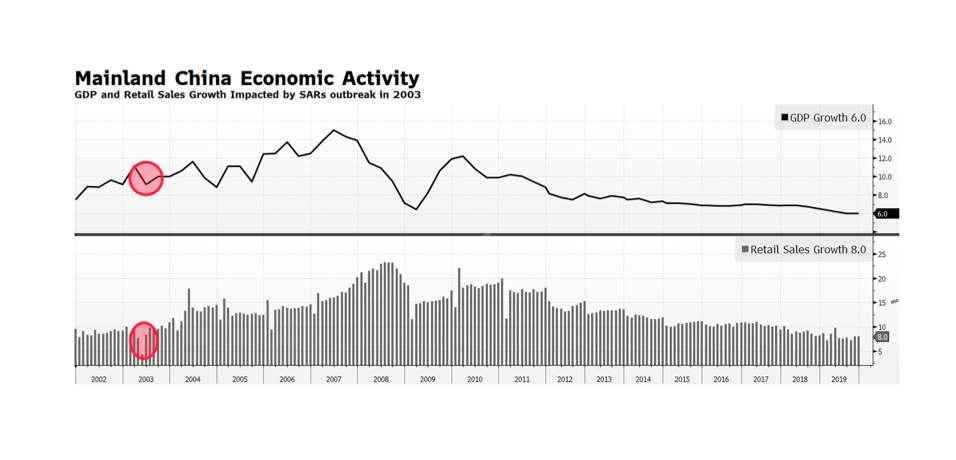

In the wake of Brexit and the risk of a pandemic it was time to take a diligent step back and compare current happenings with a bit of history. As the Coronavirus spreads within China and the WHO raises the specter of a global pandemic, investors have become concerned about the impact on the human condition and the global economy. During the SARs outbreak in 2003, Chinese economic activity was sharply impacted as GDP decelerated from 11.1% to 9.1% in the second quarter of 2003, and retail sales growth plummeted from 11.1% to 4.5% in the April to May months of that year. The SARS epidemic may, in contrast, look reasonably contained given what we don’t know about the Coronavirus. From a global economic standpoint, the Coronavirus impact is likely to be more severe given that China’s economy in 2003 represented a much smaller share of the world and it was much less consumer-oriented then. Chinese officials have limited travel and quarantined large segments of their population in order to limit the spread of the virus. Those actions will likely lead to stunted manufacturing output, and more importantly lower levels of consumption and retail sales which today represent a larger share of China’s economy. The impact of an even slower growing China will likely be a challenge for growth in the rest of the world. [chart courtesy of Bloomberg LP © 2020]