The US stock market continues to rebound from the pandemic panic-driven lows, with the NASDAQ and S&P 500 continuing to post new all-time highs over the past several weeks. This is prompting investors to question if the current rally can last, or even if it marks the beginning of a new bull market. There are risks that could derail the stock market’s advance ranging from tensions with China, resurging virus hot spots, social upheaval around the country, and the upcoming national elections. The US labor market is also a persistent drag and will not likely have recovered until well into 2021.

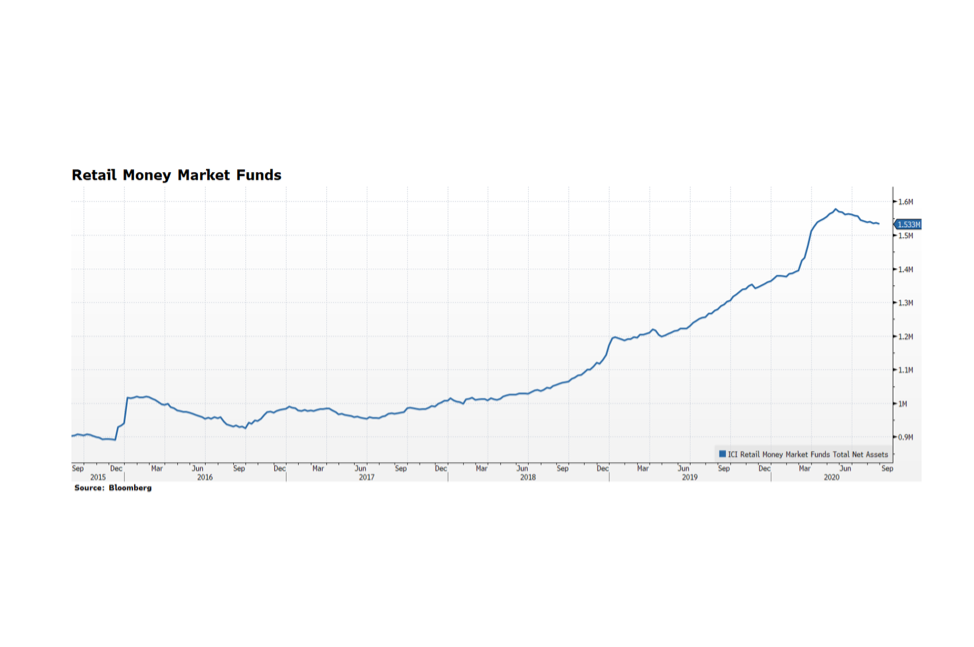

There are several factors that are supportive of asset prices including unprecedented fiscal and monetary support, and mounting positive momentum in key economic sectors such as manufacturing, housing and the consumer. As previously mentioned in our COTWs, in the US personal savings rates remain elevated and personal balance sheets have been de-levered, suggesting the consumer has the ability to spend if they wish. This week’s chart highlights total assets in money market funds, which remain near peak levels suggesting private investors have been underexposed to equities during the stock market’s historic recovery rally. This is a condition many cite as additional evidence that equities could continue to advance higher in the months ahead. [chart courtesy Bloomberg LP © 2020]