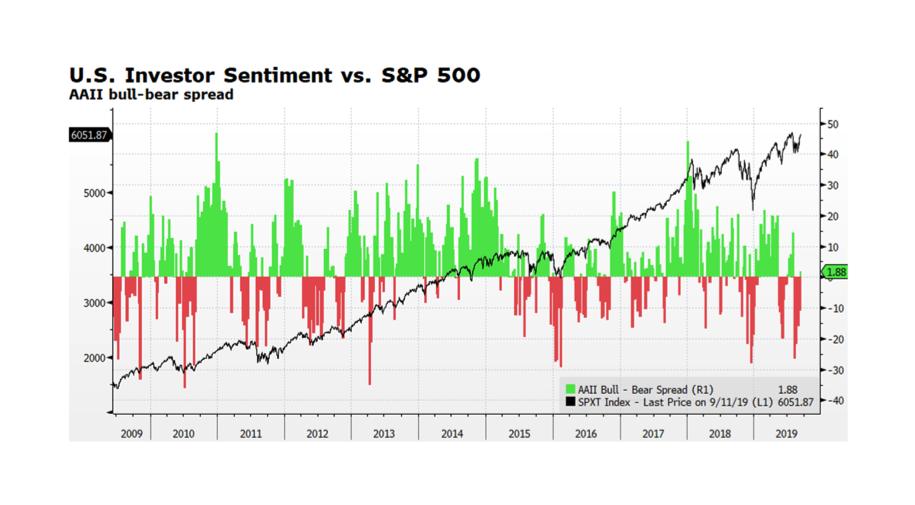

As Friday the 13ths go, not so bad. Large Cap US stocks, as measured by the S&P 500 total return index, have broken out and are approaching all-time highs reached earlier in the summer. The index spent the better part of August consolidating after peaking in late July. The positive market movement has boosted investor morale as the American Association of Individual Investors Bull-Bear Spread has just turned modestly positive. Improved investor sentiment and further market advances could persist with dovish signaling from the US Federal Reserve, a more positive tenor in US – China trade discussions, and corporate fundamentals and equity market valuations which remain supportive. The US 10 Year Treasury Yield now stands at 1.7% (9/12/2019) after reaching 1.46% on September 3, 2019 indicating that, for now, the flight to safety trade may be off as well. Many reasons to remain watchful though. Mario Draghi’s transition out of his leadership role at the ECB leaves some uncertainty regarding the bank’s future commitment to strong monetary support. The onset of Brexit carries its own uncertainties and the economic slowdown in China may be deepening.