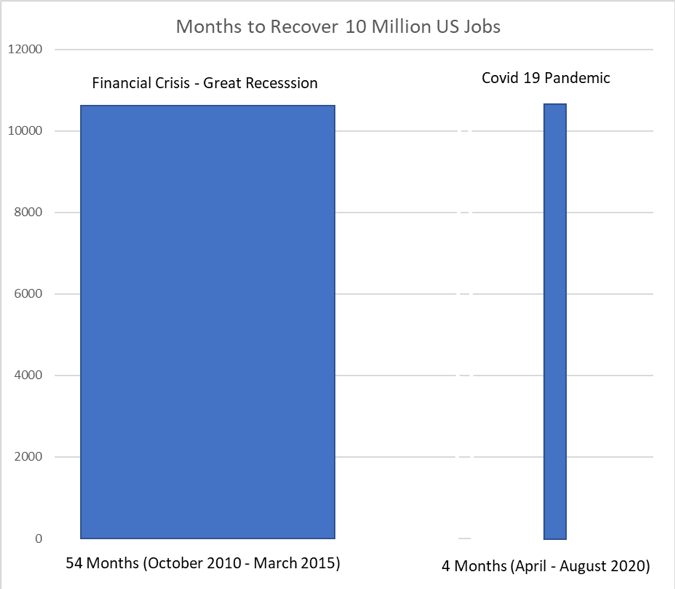

August’s labor market statistics were encouraging and suggest that the US economic recovery is far from normal. According to the BLS, Nonfarm Payrolls expanded 1.37 million in August, slightly above expectations, and the unemployment rate dropped by more than expected to 8.4% versus consensus expectations of 9.8%. While the number of unemployed dropped by 2.8 million, there are still 13.6 million Americans out of a job, which is 7.8 million more than in February. The nature of the recession, which appears to be largely behind us, is like none ever experienced because it was government induced nearly worldwide. Governments across the globe intentionally suppressed economic activity rather than act in their normal supportive role. Recessions are often caused by structural imbalances such as excess leverage in the financial sector, over-accommodative monetary policy causing hyper-extended stock market valuations, overvalued currencies and commodity price shocks. These types of imbalances did not exist in the US for the most part prior to the pandemic and that may have set the conditions for a faster recovery. One dramatic example — over 10 million jobs have been recovered since April. By comparison, it took 54 months, from October 2010 to March 2015, for an equivalent number of jobs to be recreated in the aftermath of the Financial Crisis. [data from the US Bureau of Labor Statistics]