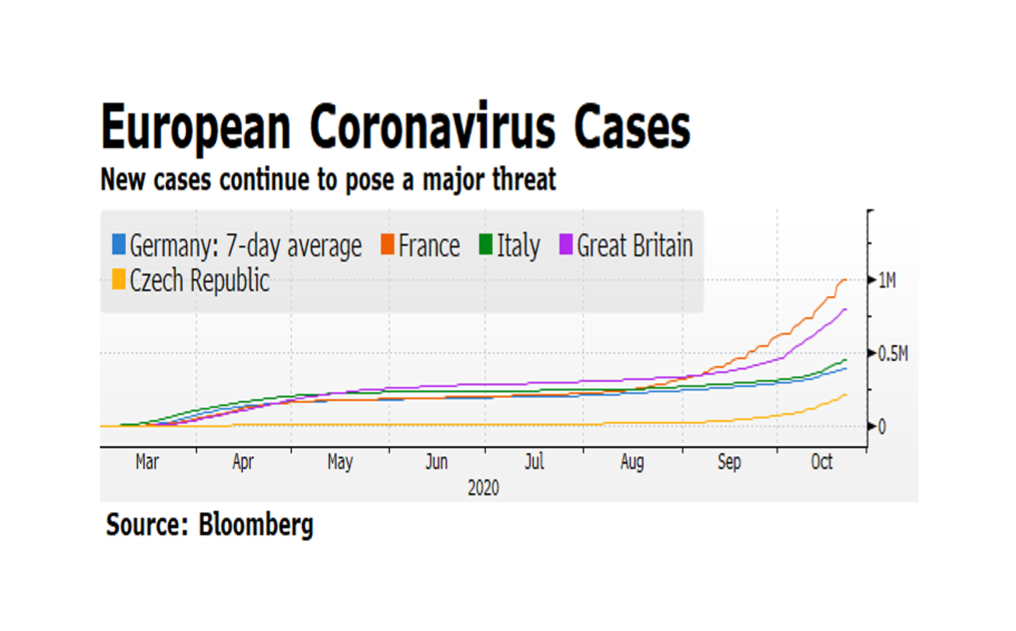

Over the past decade or more, Europe has endured several painful crises spanning Euro-related stresses to the recent Brexit uncertainty. The common thread retarding recoveries from these epochal events has been the lack of coordinated policy response, in particular fiscal stimulus. The European Union, now with the UK removed, simply does not have the strength to influence its member states to expand fiscal spending that would benefit the region beyond each country’s own national borders. Now the global Coronavirus pandemic is accelerating to frightening levels across Europe as evidenced by case momentum. The imprint on European stock prices is telling. From the onset of the pandemic, the broad-based EuroStoxx 600 is over 8% lower in US dollar terms and has been range trading since early June. By contrast, The S&P 500 is flirting with all-time highs. We believe the difference is that, while Europe has generally been more aggressive in the public health response to the pandemic, the overwhelming US fiscal and monetary response carries the day as compared to the apparent EU policy vacuum.