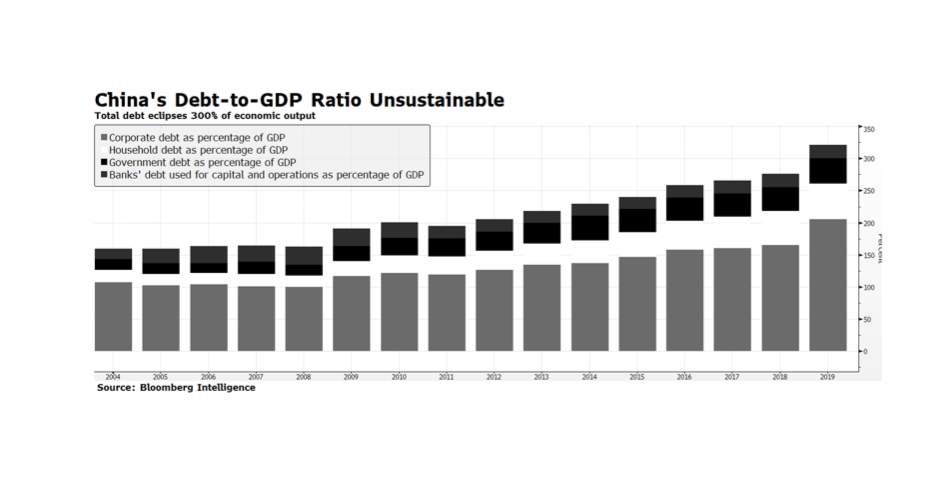

Beyond the rosy headlines of a strong economic recovery and a rally of over 40% in the Shanghai Shenzhen CSI 300 Index from the depths of the pandemic, trouble may be brewing in China’s bond markets. Total debt in China was approaching 325% of GDP in 2019, a point that economies generally struggle. The largest segment of total debt growth from 2018 to 2019 was in the corporate sector, which rose from 165% to 205% of GDP. China’s 2019 corporate debt binge appears to have hit a wall. According to Chinese media reports as much as 69% of private enterprises have defaulted on their outstanding loans so far in 2020 and the festering crisis may impact local governments and state enterprises as well. Further deterioration in the Chinese financial system would obviously have negative implications for the rest of the world.