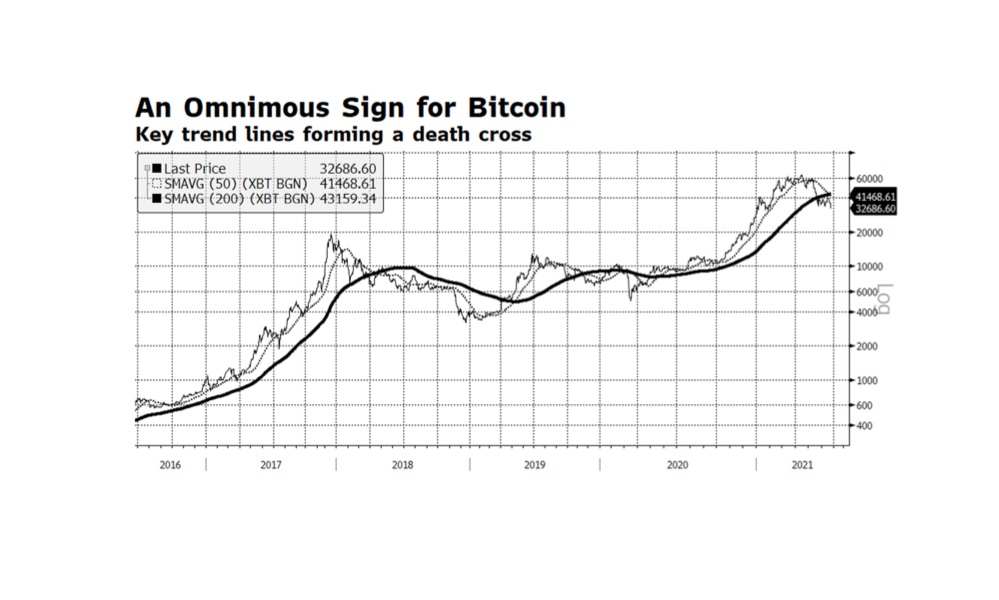

Those participating in the frenzy in crypto-related investing may be in for some more downside pain in the months ahead as a bellwether, Bitcoin, has formed the notorious “death cross”, which is when the 50-day moving average falls below the 200-day. So far it is approaching nearly a 50% drop since its peak in mid-April. Technical analysis may be more useful in evaluating the merit of such investments that have no or little fundamental data on which to base a decision. Part of the rationale for investors to acquire positions in Bitcoin and other related investments lies in the idea of using them as a means of exchange and potentially as a store of value. The latter dimension has been gaining credibility as major central banks continue to pursue aggressive quantitative easing, effectively debasing their currencies to one degree or another. We cannot divine where the trend in cryto investing is headed in the intermediate term, but there is no denying that interest is growing. If recent history is any guide, investors who chose to hold these investments need to be prepared for further losses. The previous two times when death crosses were formed in 2018 and late 2019, losses surpassed 64% and 30%. Not for the faint of heart. [chart courtesy Bloomberg LP (c) 2021]