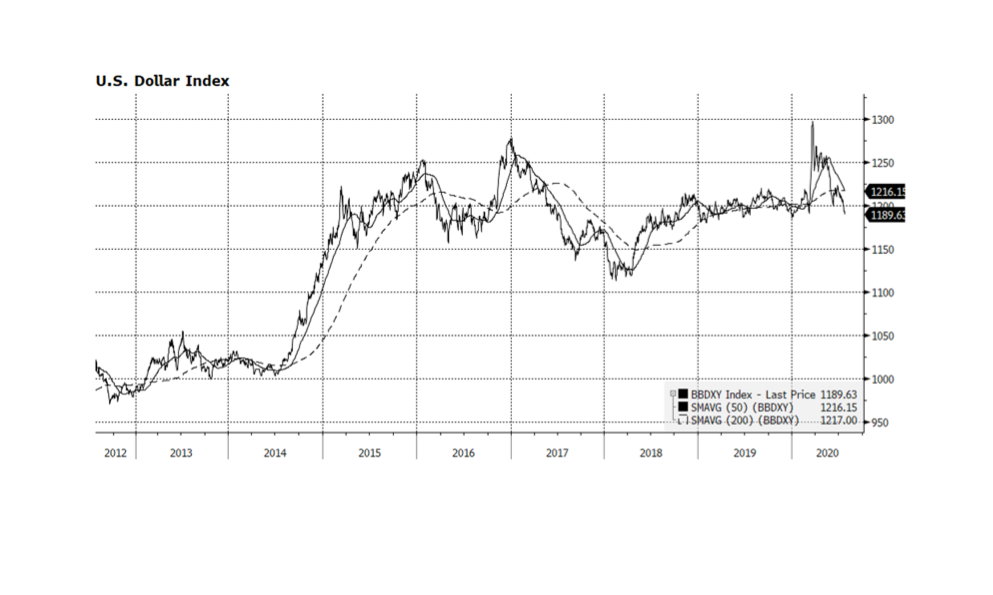

The US dollar’s dominance versus the world’s leading currencies may be nearing its end, at least cyclically. Bloomberg’s US Dollar Spot index is essentially flat year-to-date and has given up all its COVID-19 flight-to-safety gains. Since March 20th, the index is down over 8%, driven by gains in the Euro and British Pound. This could be an indication that conditions in the rest of the world are improving, a welcome sign if indeed it proves to be true. One key development in our view, is that the European Union has agreed to a desperately needed 750 billion Euro ($857 billion) pandemic relief plan that is being financed collectively for the first time in history rather than by individual nations. The relief will be targeted at nations hit the hardest and will take the form of grants that will not have to be repaid. This is noteworthy because, for decades, richer northern European nations resisted aiding economically challenged countries during times of duress. This event could prove to be a watershed moment that could lead to a stronger European Union economically and politically and that would be good for the world. [chart courtesy Bloomberg LP © 2020]