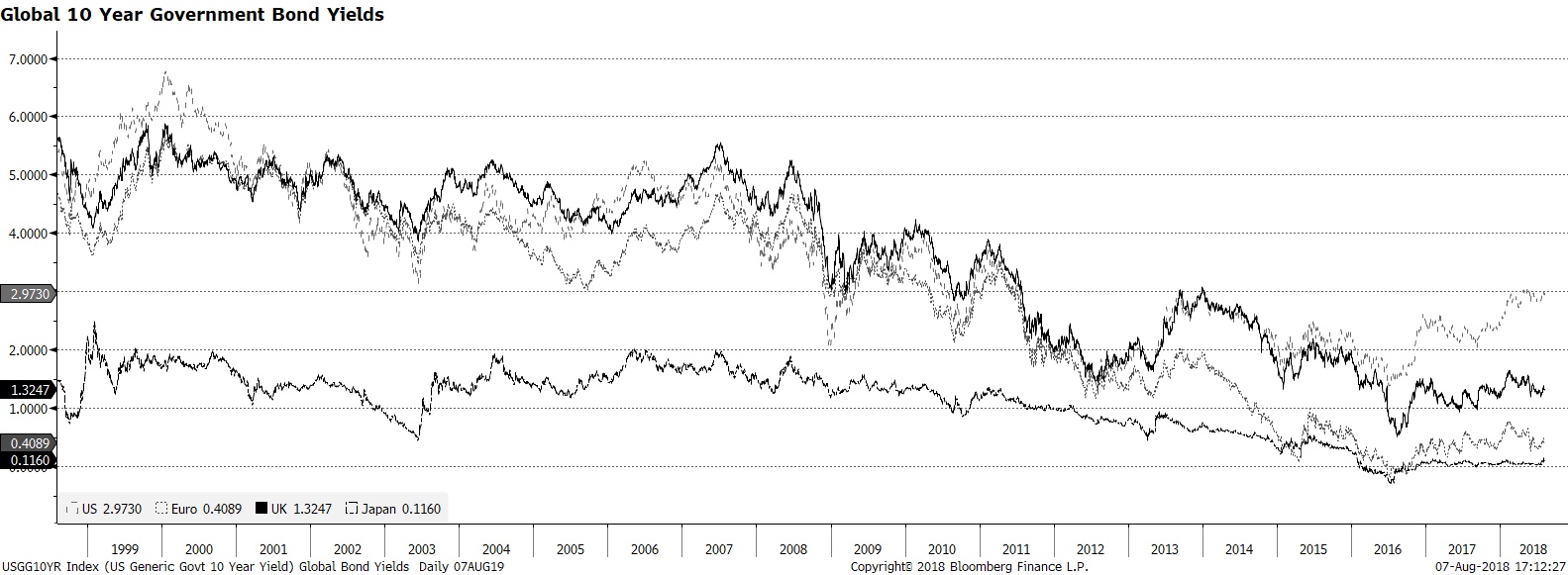

JPMorgan’s CEO Jamie Dimon, arguably the world’s most influential banker in decades, is known for making headlines. This week he commented that investors need to get ready for interest rates on the benchmark US 10-year treasury approaching 5%. Many reacted with skepticism given current yields hovering around 3%, but robust economic conditions in America should push interest rates to more normal levels. Prior to the crisis, yields on benchmark government bonds in the US and Europe were hovering near Dimon’s stated range, consistent with long-term nominal economic trends. We do not take issue with his comments; we only suggest that they be considered in a global context. Interest rate differentials in the western world that were fairly tight prior to the crisis have diverged over the course of the past five years or so. We have believed for some time now that rates in the US will be tethered lower due to anemic economic conditions in the rest of the developed world. Is this a longer-term or near-permanent investment condition with respect to the Eurozone? Japan has had to deal with low yields, sluggish economic growth and persistent deflationary pressures for years. Europe is more diverse and arguably more dynamic than Japan but… #moreofthesame #Fed #lowrates #yield #lostdecades