Over the past week or so turbulence has returned to US equity markets as several leading social media companies have announced disappointing results. However, according to Bloomberg, approximately 85% of S&P index members have exceeded expectations this earnings season, yet the market reaction has been muted. Investors may be concerned about the length of the current bull market and its ability to climb higher despite positive US corporate results. This is understandable given how far the S&P 500 has risen since the financial crisis.

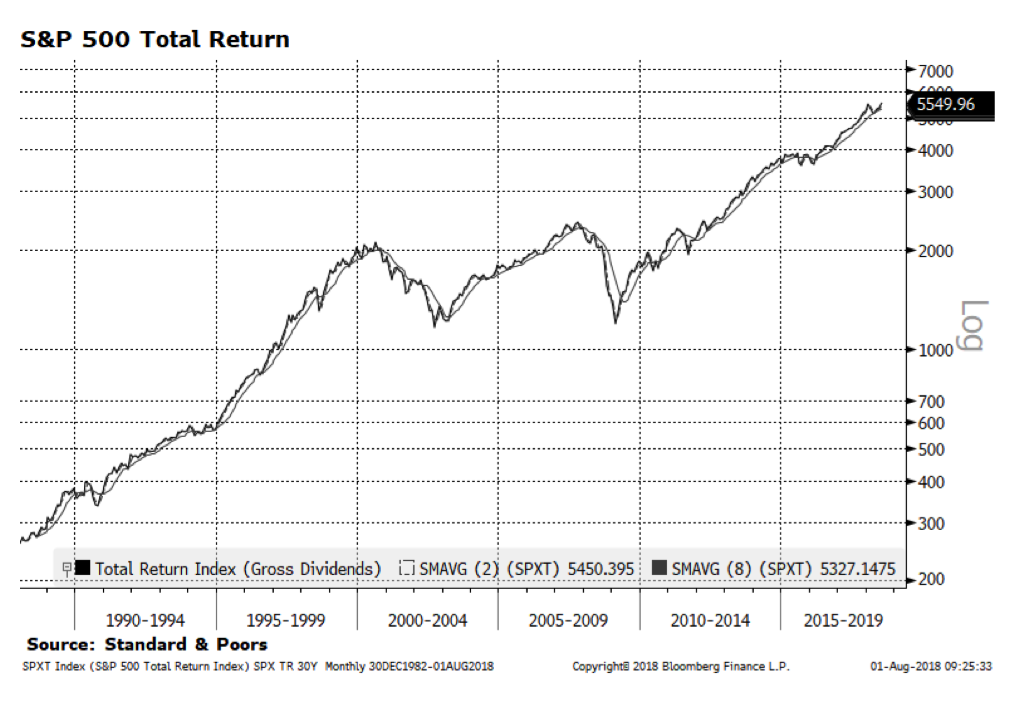

However, we would point out that the S&P 500 measured on a total return basis including gross dividends (pictured below in log scale) had a longer and steeper ascent from the late 1980s until the technology bubble burst in 2000. The market during the tail end of that period was also driven by the technology sector but valuations were bloated then as earnings in many cases were weak or non-existent. From a market psychology perspective, last week brought good news — on July 26 the S&P 500 total return index closed at an all-time high of 5,607.99. We are mindful of current valuation metrics and believe the overall market can advance further if earnings continue to be robust.