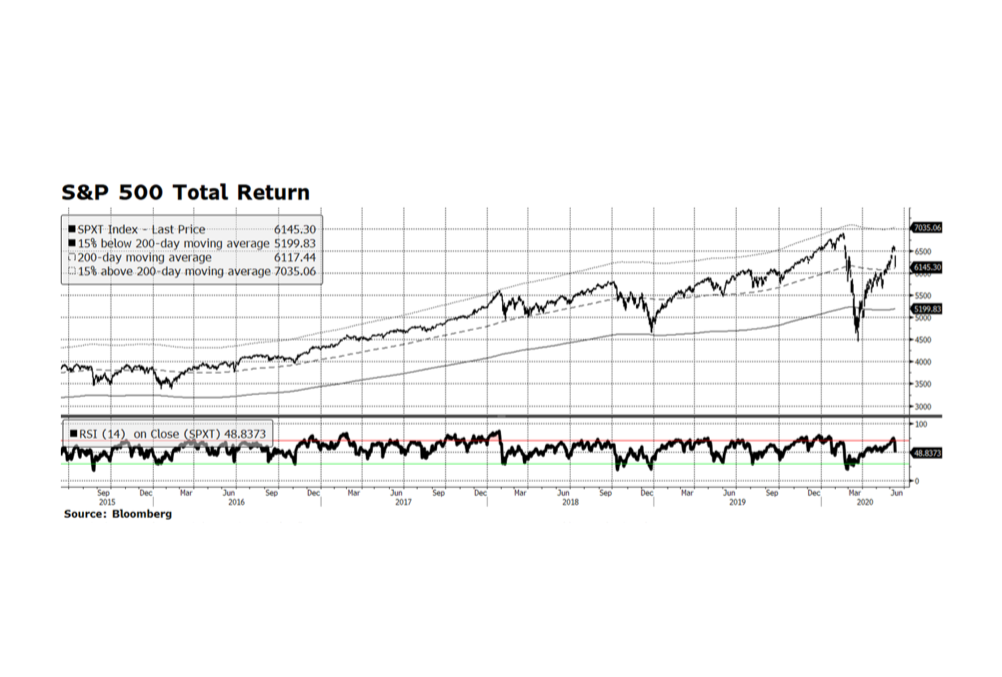

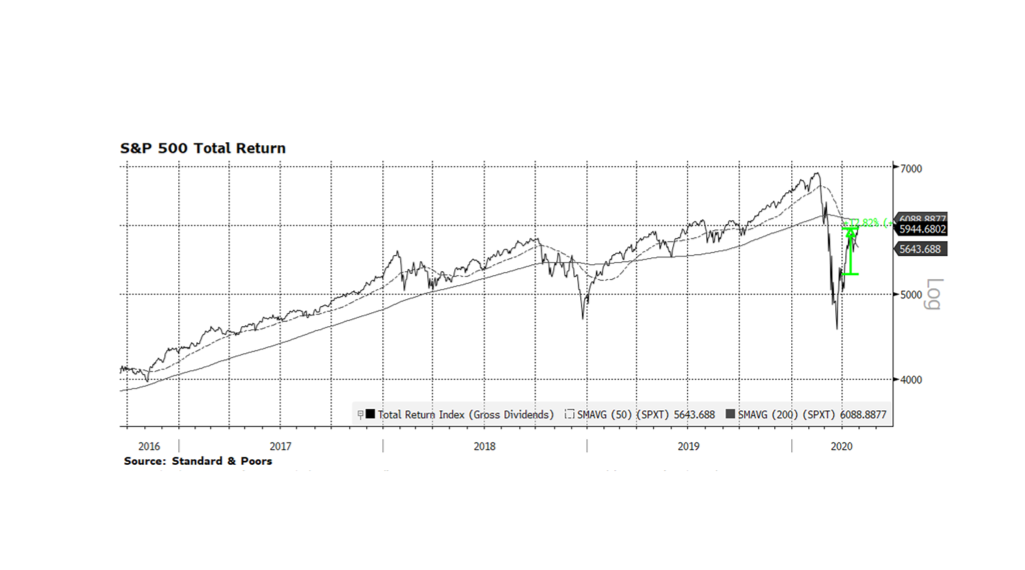

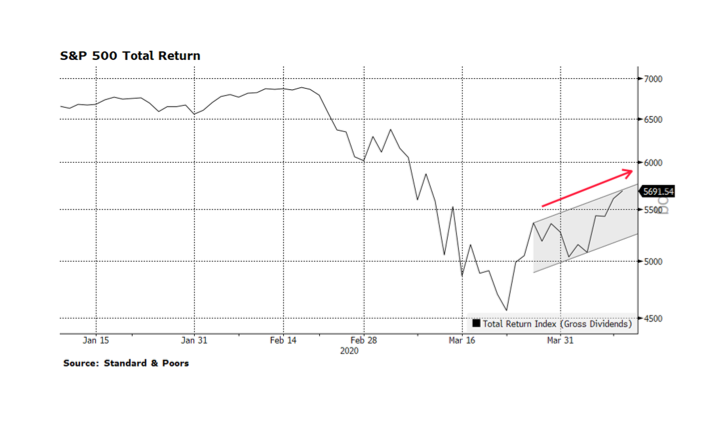

The main equity indices in the US were routed this past Thursday, making the week negative for the first time in three. The decline was likely due to concerns about climbing rates of COVID-19 in new parts of the country, and comments made by the Chairman of the US Federal Reserve (Powell) regarding the economic challenges ahead. Thursday’s sell-off was the worst in percentage terms for the S&P Total Return Index since March 16, a week before the gauge made its cyclical bottom. Another factor may have been that the US equity market was extended heading into the week. Still, on Thursday the index managed to close above the 200-day moving average, and on Friday rebounded 1.3%. Prior to Thursday, the index was elevated well above that long-term measure, so some give back was reasonably expected. Friday’s gain is encouraging but we are mindful of the real challenges facing the US economy and capital markets going forward. The next several trading days will be telling. [chart courtesy S&P and Bloomberg LP © 2020]