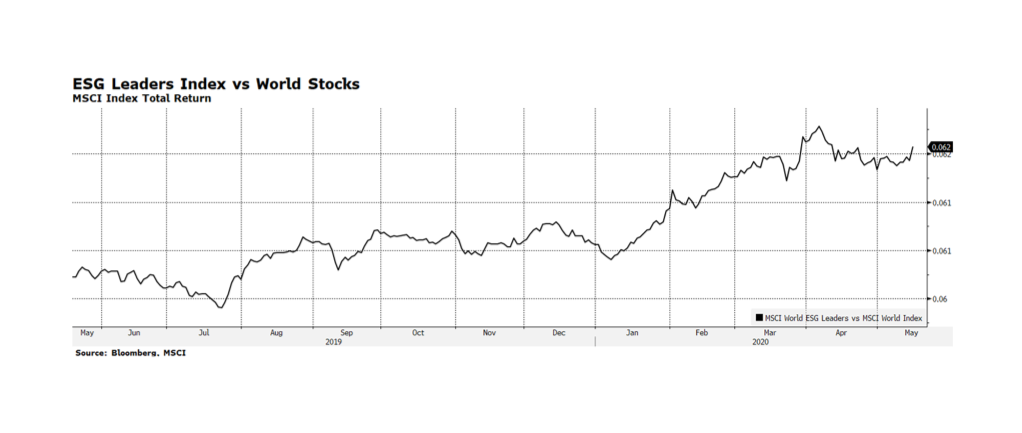

Stocks of companies that qualify for inclusion in the MSCI Global ESG Leaders Index have outperformed global peers for the better part of the past year and most importantly during the global health crisis. The most recent few months have seen terrible loss of life and livelihood, sorely testing the resiliency of sustainably oriented companies. Based on full-market comparisons, it appears the environmental, social and governance focus of these companies has collectively contributed to outperformance relative to their less ESG-centric peers. The avoidance of or minimal revenue related to the (old) carbon economy is certainly a factor, with world oil prices falling by over 50% in the last year and energy price volatility contributing to earnings uncertainty across a number of industries. Our core thesis has been that investments that express better ESG performance will deliver market or better financial and market performance over the long term. Building on that, we have seen in the second global economic and societal crisis in a dozen years that these investments also have the potential to guard against risk and outperform in moments of peak stress as well. [Chart courtesy MSCI and Bloomberg LP © 2020]