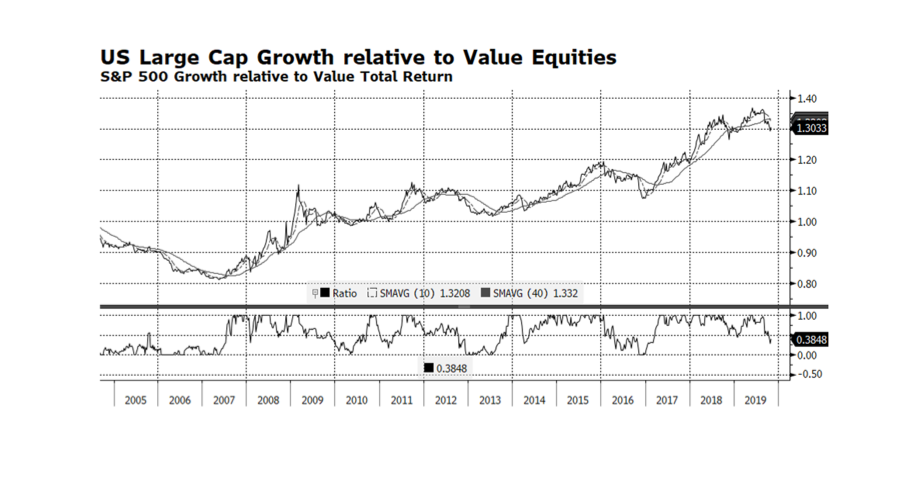

Growth stocks in the US have outperformed value stocks for the better part of the past three years with the exception of the US Fed induced sell off at the end of last year. However, since mid-August value stocks have outpaced growth stocks by a considerable amount rallying nearly 8% versus 3.5% according to S&P 500 Value and Growth indices. If value stocks can continue to outperform or even keep pace with the overall market, we would view this as a positive development because it could mean that broader participation is developing. That is important because the S&P 500’s largest the sector, Information Technology, continues to outperform, powering the market higher. We find this interesting because usually technology stocks outperform with growth leading value. [chart courtesy Bloomberg LP © 2019]