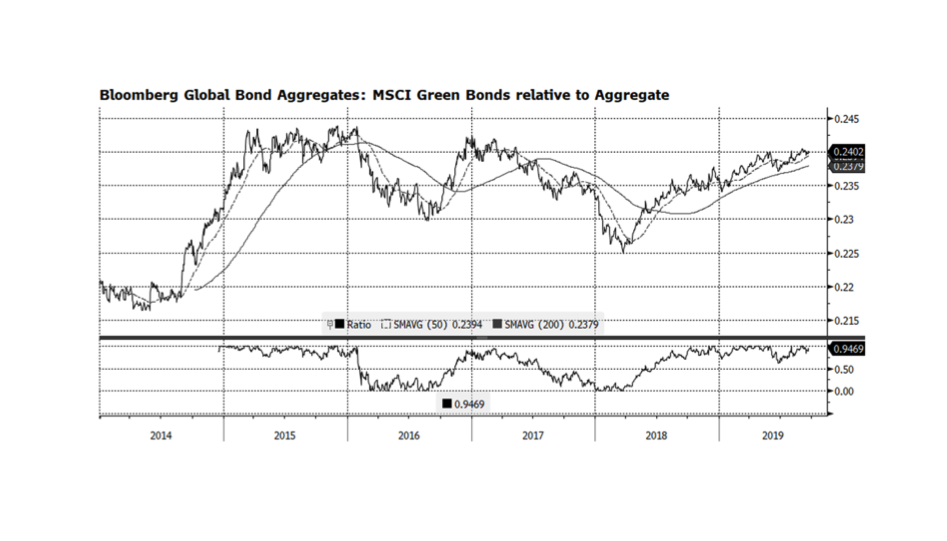

On this convening day for the UN Climate Action Summit, we take a fresh look at the benefits of climate-centric fixed income investment strategies. There is a persistent myth that disciplined ESG investing dampens investment performance, which we believe is short sighted. This week’s chart examines the total return properties of the Bloomberg Barclays MSCI Global Green Bond Total Return Index versus the Global Aggregate equivalent index. The green bond Index is based on issuers that adhere to the Green Bond Principles which include energy efficiency, renewable energy, pollution prevention and control, sustainable management of land and natural resources, potable water and wastewater management, and clean transport among other critical green activities. What this relationship shows us is that there are periods when the green index underperforms and also periods when the index outperforms the broader aggregate index. This index started at the end of 2013, so we have nearly seven years of data to evaluate. According to Bloomberg, over that time frame (as of September 20, 2019), the green index is up 22.3% compare to 12.2% for the global aggregate or annualized total returns of 3.6% and 2.0%, respectively. Clearly, over the longer term, green-oriented fixed income investors have done well by investing in issues that are doing good as compared to the overall global bond market. [Chart courtesy Bloomberg LP (c) 2019]