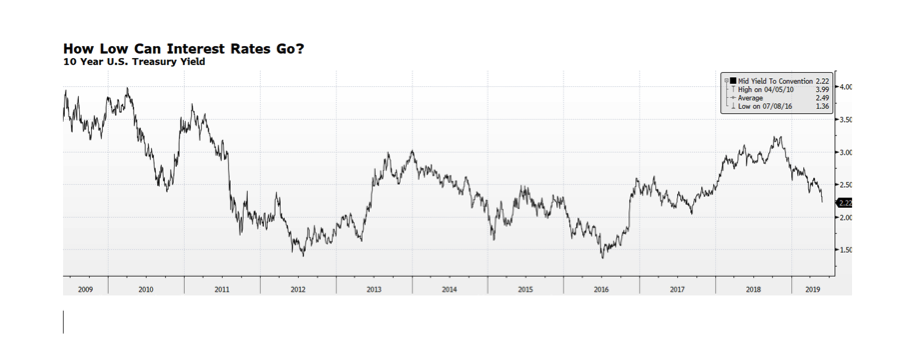

The yield on the 10-year US Treasury has fallen to 2.22% (as of May 29th) which is 100 basis points from the recent high reached on November 8, 2018. The rapid decline in rates, 29.8% from last November’s levels, has many investors unnerved as a portion of the yield curve is inverted. That historically has signaled oncoming recessions. Interest rates could fall further from here. Over the past decade, there have been at least seven distinct periods where yields have fallen, averaging over 39% from peak-to-trough. The duration of those periods averaged 7.6 months while the current downtrend has lasted six months, 11 days and counting. There are several reasons why rates could continue to fall, ranging from the ongoing and unpredictable effects of the US-China trade negotiations, political disfunction in the EU and Great Britain, the lack of inflationary pressures globally and negative interest rates for comparable government bonds in Germany and Japan. The risk for investors chasing this treasury rally is that any escalation in yields from these low levels would result in material loss of principal. [chart courtesy Bloomberg LP (c) 2019]