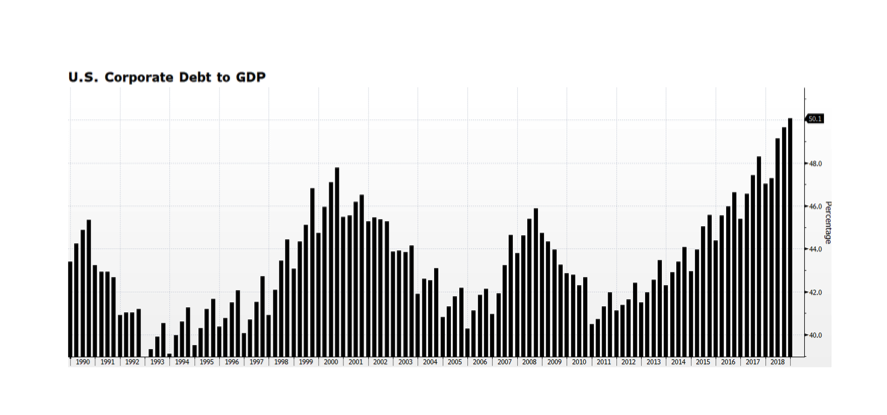

Monday’s remarks by Jerome Powell, Chairman of the US Federal Reserve, raised some eyebrows in financial circles. He stated “Business debt has clearly reached a level that should give businesses and investors reason to pause and reflect” and “Another sharp increase… could increase vulnerabilities appreciably”. These comments prompted some investors to draw comparisons to the mortgage crisis. The chart below shows US corporate debt to GDP levels, currently at a 30-year high of 50.1% (vertical axis), and it is alarming. Not only does the current reading exceed the Financial Crisis but the measure also exceeds readings reached during the debt-fueled technology bubble era. One major difference today is that during both previous crises, interest rates (yield-to-worst according to the Bloomberg Barclays US Corporate Debt Index) were near or above 8% whereas now rates stand at 3.6%. Powell did qualify his comments by adding that debt servicing costs remain low and debt growth is in line with GDP growth. Cold comfort unless rates remain structurally lower for longer.