We’re back to charts after a holiday week hiatus, but Italy didn’t take a break. Another Euro-related crisis may be lurking in Italy as the populist coalition government, consisting of the Five Star Movement and the far-right League parties, have formed an administration. Although the parties have dropped some of their most alarming campaign rhetoric concerning exiting the Euro and EU, investors have re-focused on Italy’s sovereign debt levels now surpassing 130% of GDP (well beyond EU budget rules) and the limitations it imposes on fiscal flexibility.

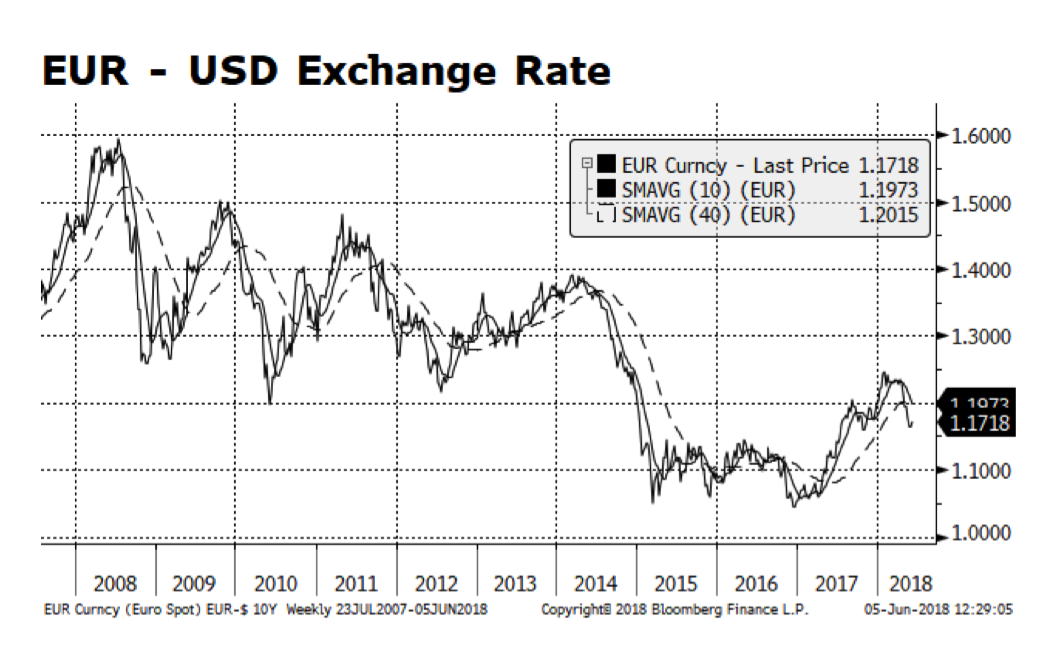

Not surprisingly, the Euro has weakened considerably — particularly against the US Dollar. The cause of the softening Euro likely spans beyond Italy’s contribution of 15% EU GDP. Several key Eurozone economic indicators such as industrial production, business sentiment and consumer confidence appear to be losing momentum.