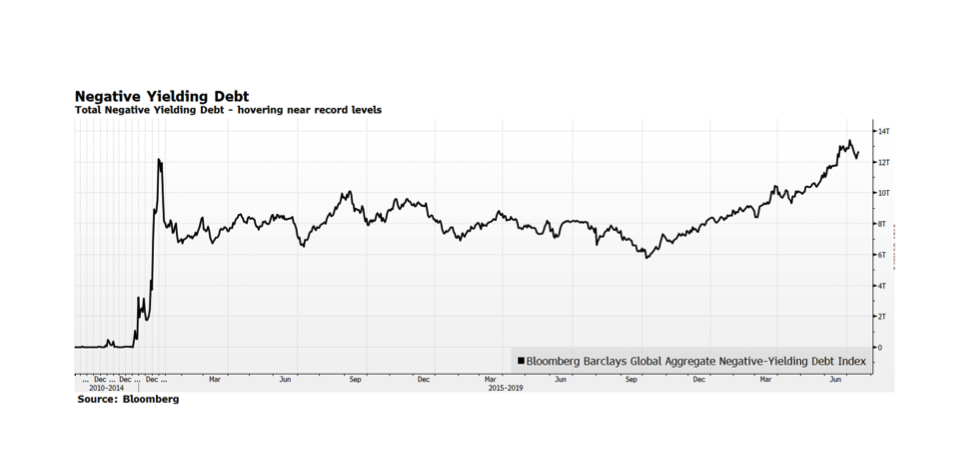

The total amount of negative yielding debt has been steadily climbing (in fact doubling) since last September, and now stands at a staggering $12.7 trillion dollars according the Bloomberg Global Aggregate Negative-Yielding Debt Index. Negative yielding debt now represents over 23% of the Bloomberg Global Aggregate Index and consists of both investment grade corporate and sovereign bonds, predominantly in Continental Europe and Japan, areas of the capital markets we have avoided. Hyper-accommodative monetary policy throughout the world in the form of quantitative easing, and negative interest rate policy in particular, is the main impetus producing this upside-down phenomenon of forcing investors to pay to hold bonds. The risk is that this negative income stream situation will be adversely compounded as interest rates ultimately rise, risking principal, in our view. We are concerned how long these conditions can persist and the ultimate fallout on the real economy and capital markets.