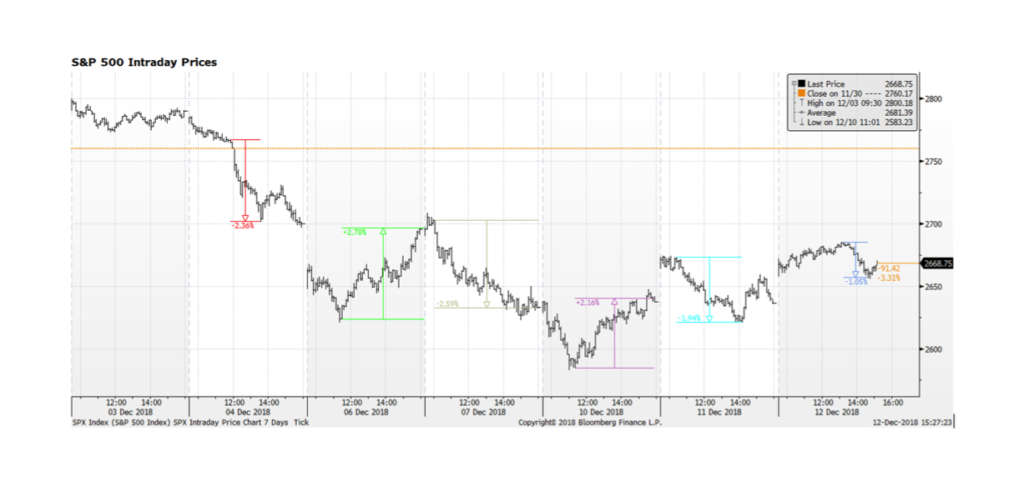

The past few weeks have been harrowing for investors, and since December, intraday price movements of the S&P 500 appear to be increasing. There have been five consecutive days in which the index has swung up or down 2% or more. Heightened intraday volatility usually precedes a change in market direction and is a key factor to monitor. We are constantly searching for a trigger to put a bottom in equities but for now investors are focused on the outcome of next week’s Fed meeting and its impact on interest rates, along with political tension in Europe and the UK as well as tariff and trade friction between the US and China.