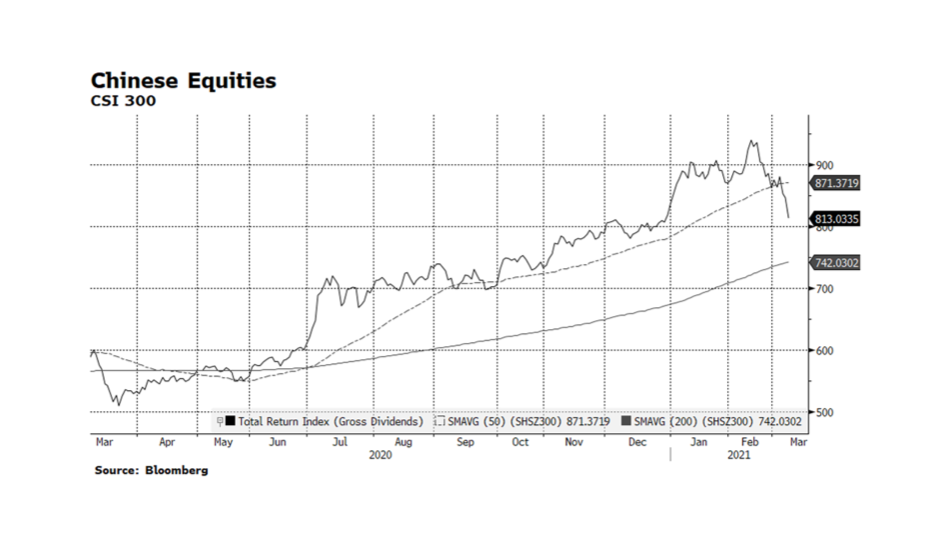

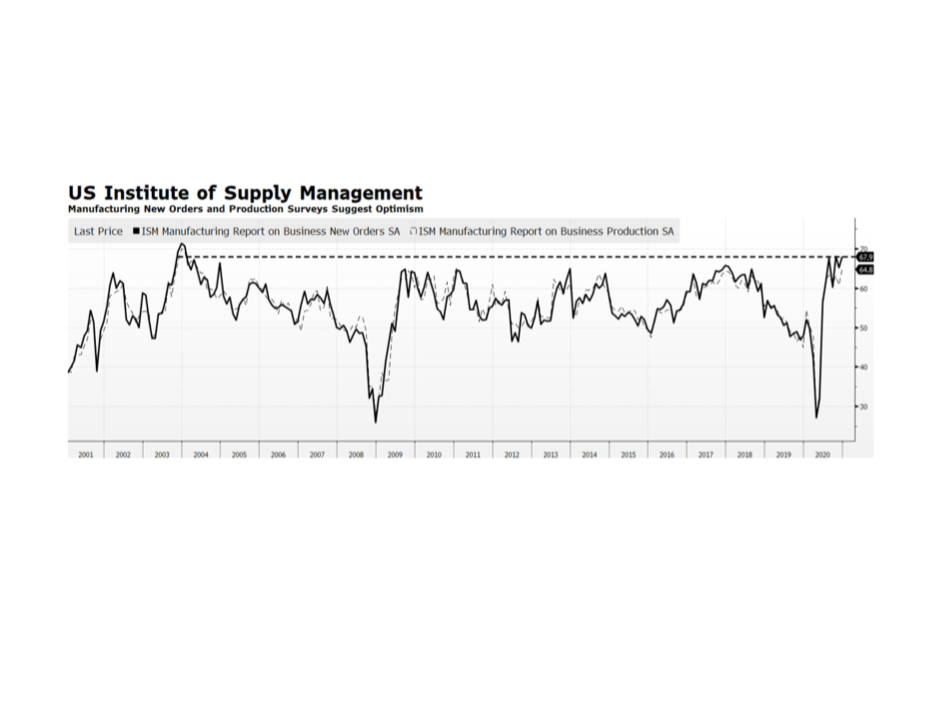

According to the widely followed Shanghai Shenzhen CSI 300 Index, Chinese equities have abruptly fallen into correction territory, declining over 12% from their near-term peak on February 10th. The consensus is the correction was overdue given extended valuations of the dominant companies in the index. Historically, Chinese share prices have been volatile but tolerant investors have been rewarded with strong relative returns. However, this rout is concerning because market participation within China has been declining since late Summer 2020. Chinese equities did help lift share prices across Asia, broadening the global stock market rally beyond just US technology companies. But, we are now seeing some of the flipside of this correlation as price action in Chinese stocks is adversely impacting broader Emerging Market equities which have been among the world’s top performing assets so far this year. [chart courtesy Bloomberg LP © 2021]