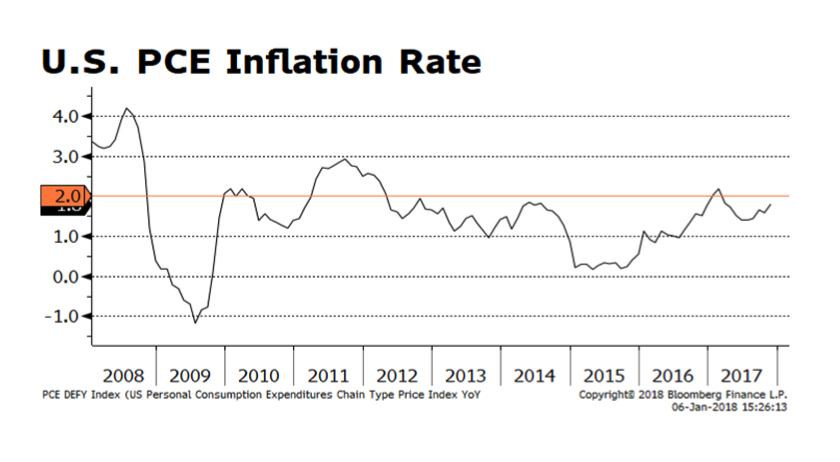

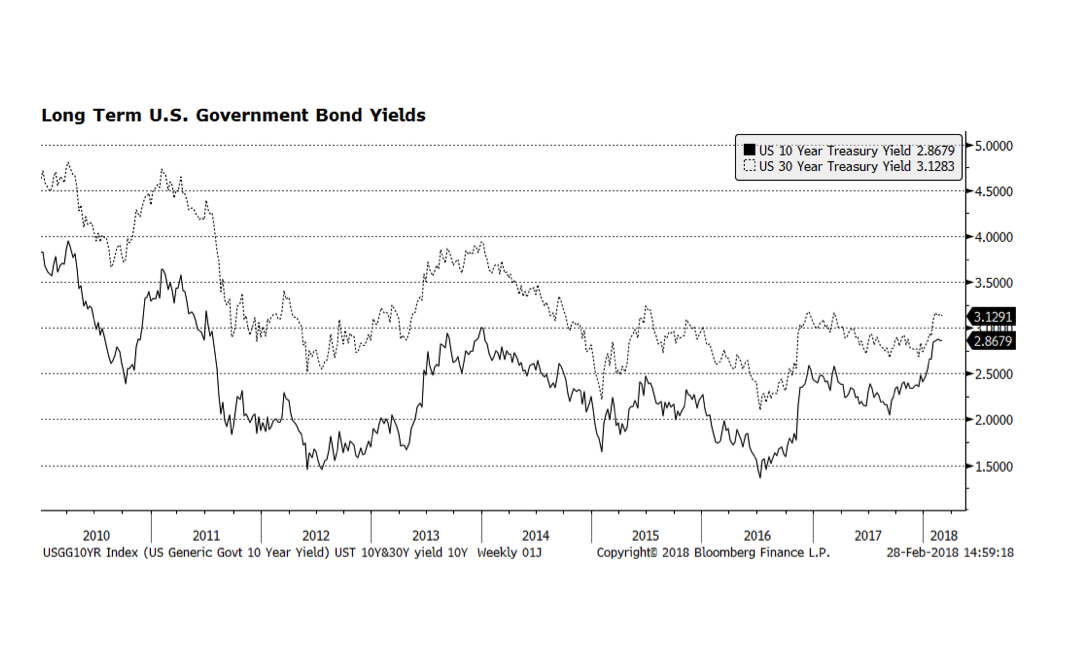

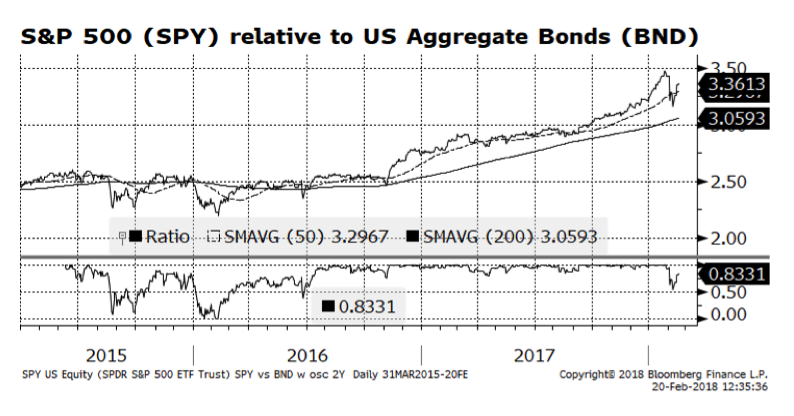

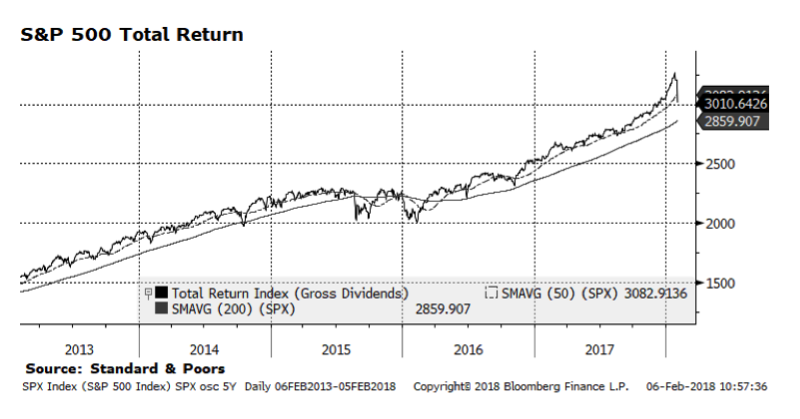

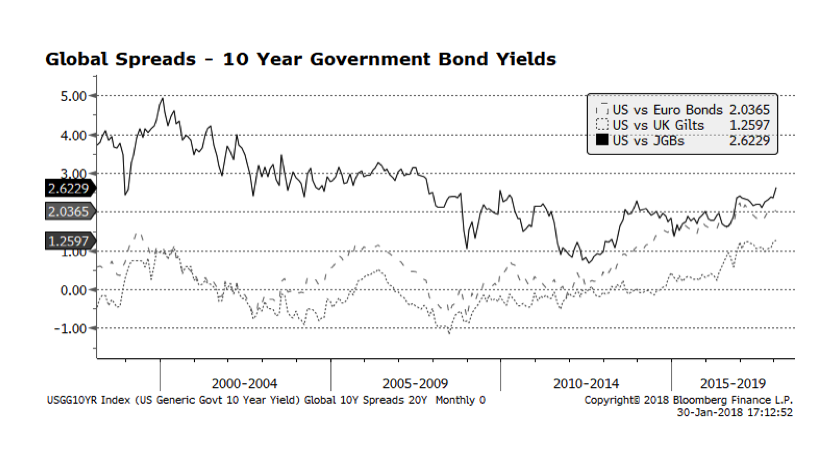

We decided to sit this one out. The way the market just whipped around over the last few weeks with little provocation, our concern was about informationless volatility, and we did not want to jump into the fray with comments much less action without any additional insight. In our view, there was very little if any new information that came into the market to trigger the bout of vol. A lot of observers and pundits were pointing to data about jobs (or was it wage growth, or perhaps it was GDP?) that signaled the potential for inflation, and with it the specter of a Fed getting the knives out to cut back the easy money. But, at least from our perch, these new data points were not only knowable, they were known, and they were not new. Perhaps rate watchers and equity market participants were hoping if they clenched their eyes very tightly the hallmarks of an expanding economy might go away on their own.

In terms of purchasing power, there has not been real wage growth for at least a couple decades for the cherished middle class, much less their undercompensated neighbors further down the economic ladder. Even at sub-5% unemployment, the quality of jobs may be poor in terms of wages and ability to exploit workers’ educations, skills and capabilities, and many of those workers would take more hours if only they were available. Compounding that, a significant and growing portion of the workforce is self-employed, and not by choice. Many jobs that used to be salaried and permanent, including knowledge economy jobs that were supposed to be the future of employment, have become temporary 1099 gigs if they have not been shipped overseas entirely. When looking at the fundamental reality on the ground, we could not find a rational explanation for why markets choked on encouraging but fairly benign data. An overheating economy appears still far off in the future and the Fed’s path to higher rates is inexorable, yes, but also slow and deliberate.

So what happened?

Continue reading

Don’t forget to follow us on Instagram, Facebook and LinkedIn to get the COTW in your social media feed.

Don’t forget to follow us on Instagram, Facebook and LinkedIn to get the COTW in your social media feed.

On Dr. Martin Luther King, Jr. Day, it is a good time to listen rather than speak. Here are a few places to go to hear about both the legacy and the present day state of social and economic justice in the United States:

On Dr. Martin Luther King, Jr. Day, it is a good time to listen rather than speak. Here are a few places to go to hear about both the legacy and the present day state of social and economic justice in the United States: