And we’re back! Happy New Year to our friends, clients and partners.

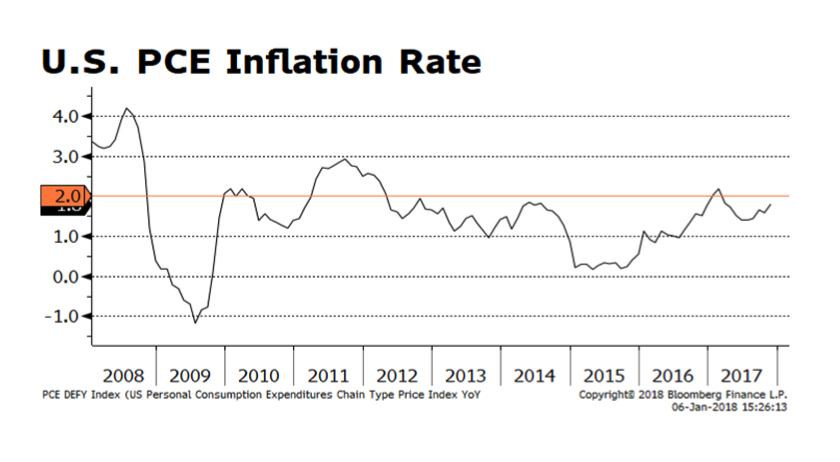

US Personal Consumption Expenditure (PCE) Prices, depicted in this week’s chart, is an inflation indicator that we follow closely. It is still below the US Federal Reserve’s 2% target, but getting closer. This has historically been among the favorite inflation indicators monitored by the Fed and Fed watchers. Our concern is that, if inflationary pressures prompt the new Fed leadership to adopt a more rapid approach to raising the Fed funds target rate, the yield curve could flatten further or even invert. Complicating this picture is that comparable longer-term yields in Europe and Japan will likely stay lower for longer due to central bank intervention. The result could continue to tether comparable US treasury yields and lead to a yield curve inversion in the US, which in the past has been a reliable precursor to recession. However, such an inversion caused by central bank intervention rather than from the natural course of the business cycle could produce unpredictable consequences. This relationship bears watching.